Now Reading: How to Transfer Credit Card Balances: A Simple Guide to Save Thousands

-

01

How to Transfer Credit Card Balances: A Simple Guide to Save Thousands

How to Transfer Credit Card Balances: A Simple Guide to Save Thousands

Did you know that a balance transfer credit card could save you thousands on interest payments?

Popular cards like the Wells Fargo Reflect® Card and Citi Simplicity® Card offer 0% introductory APR for up to 21 months. This is a chance to cut down your debt burden by a lot. You’ll get almost two years to pay down your balance without any extra interest charges.

The process isn’t without its costs. Most cards charge a balance transfer fee ranging from 3% to 5% of the transferred amount. A $5,000 transfer would cost you about $250 in fees. On top of that, it takes good to excellent credit scores (670 or higher) to get approved.

Balance transfers can still make debt management easier by putting all your payments in one place. Your credit score might even go up when you handle these transfers well. The main reason is that they help lower your overall credit utilization.

In this piece, we’ll show you everything about credit card balance transfers. You’ll learn what they are and how to get the most savings during the promotional period.

What Is a Balance Transfer and How It Works

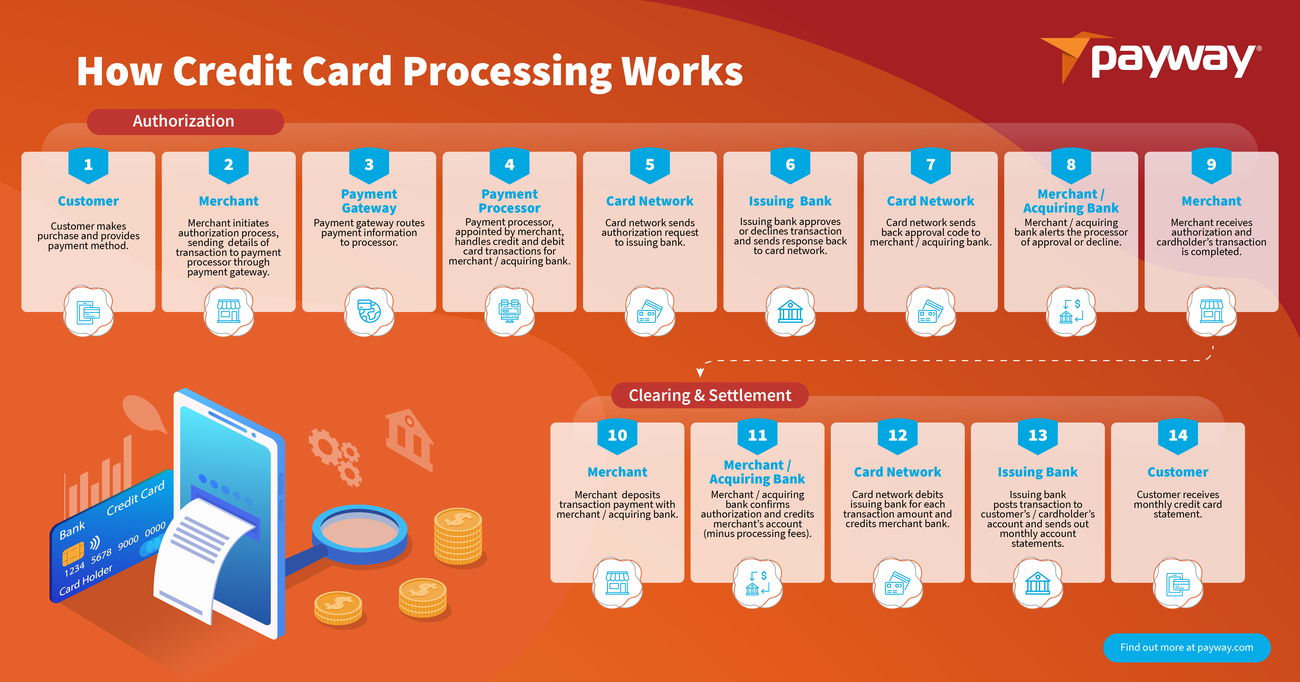

Image Source: Payway

A balance transfer lets you move your existing debt from one or more credit cards to another card that has a lower interest rate. More and more people now use this smart money move to handle their debt better.

Definition and purpose of a balance transfer

Here’s what a balance transfer is all about: you move your debt from a high-interest credit card to one that gives you better terms. Most balance transfer cards come with a low or 0% introductory annual percentage rate (APR) that lasts for a set time. You’ll get this special rate for 6 to 21 months. This gives you plenty of time to tackle your debt.

The reason to do a balance transfer is simple – you save money on interest while paying down what you owe. Moving your balance to a card with lower interest helps you cut down your debt faster.

Let’s look at a real example: A $5,000 balance on a credit card with 20% APR needs $250 monthly payments. This takes 24 months to clear and costs about $1,134 in interest. But if you move this balance to a 0% APR card, you won’t pay any interest during the special rate period.

Balance transfers also make your finances easier to manage. Instead of juggling several cards with different due dates, you’ll only need to track one monthly payment.

How it helps reduce interest payments

The best part about a balance transfer is the money you save on interest. With a 0% APR intro offer, every penny you pay goes straight to reducing your debt instead of getting eaten up by interest charges.

The numbers tell the story: moving your high-interest balance to a 0% APR card could save you $956. You might even pay off your debt five months earlier. This works because your payments reduce your actual debt rather than covering interest.

Your total debt stays the same after the transfer, but the lower interest rate means you’ll save big on interest charges. This helps you get out of debt faster.

Note that most balance transfers include fees—usually 3% to 5% of what you transfer. For a $5,000 balance, you’ll pay between $150 and $250. The upfront cost might seem high, but the interest savings make it worth it for people with lots of debt.

The best way to use a balance transfer is to pay off everything before the special rate ends. This way, you only pay the transfer fee. After the special rate period, regular interest kicks in—and these rates can go up to almost 30%.

A balance transfer can be a lifeline if high-interest credit card debt has you stuck. Use it wisely, and you’ll have a clear path to becoming debt-free under better terms.

When Should You Consider a Balance Transfer?

Image Source: Credit Karma

The right moment to transfer your credit card balance is vital to get the most benefits. You shouldn’t rush into transferring balances – take time to evaluate your finances and future goals.

Signs you’re paying too much interest

Your interest payments might be too high if you only make minimum payments each month. Financial planners raise red flags when they see three consecutive months of minimum payments, as it points to serious debt problems. This pattern should worry you because most of your money pays interest instead of reducing what you actually owe.

Let’s look at a real example: A $100 monthly payment where $80 goes to last month’s interest means you barely make progress on your actual debt. You end up stuck in a cycle where your payments don’t help you get ahead.

High interest rates are another warning sign. If you’re paying credit card interest rates of 20% or higher, you need to act. Many cards now charge APRs up to 28% or more. Your debt grows faster than you can pay it off at these rates. Financial experts call it negative amortization – your balance keeps growing even though you make regular payments.

Missing due dates or moving money between cards to make payments tells you that interest charges have gotten out of hand.

Situations where a transfer makes sense

Balance transfers help in specific cases. We found they work best when your debt would take several months or longer to clear. The fees might not be worth it if you could pay off your balance in a couple of months anyway.

You’ll get the best deals if you have good to excellent credit. This helps you qualify for competitive balance transfer offers. Without strong credit, those advertised promotional rates might be out of reach.

On top of that, balance transfers work better once you’ve fixed what caused your debt. This means you’ve got your spending under control, know your budget really well, and have a clear plan for monthly debt payments.

Timing plays a big role too. A balance transfer makes sense when:

- Your finances look stable for the next 12-21 months

- You won’t need major loans like mortgages or car financing soon

- Your debt feels tough but not impossible to handle

Balance transfers can help manage temporary cash flow problems. Business owners who face short-term revenue ups and downs might use transfers to bridge the gap until money comes in.

Combining multiple credit card payments that have different due dates through a balance transfer can make your finances simpler. People stay on track and avoid late payments with this streamlined approach.

Note that successful balance transfer candidates see this as a debt management tool – not a way to pile on more debt. You should aim to clear your balance before the promotional period ends to save the most money.

How to Transfer Credit Card Balances Step-by-Step

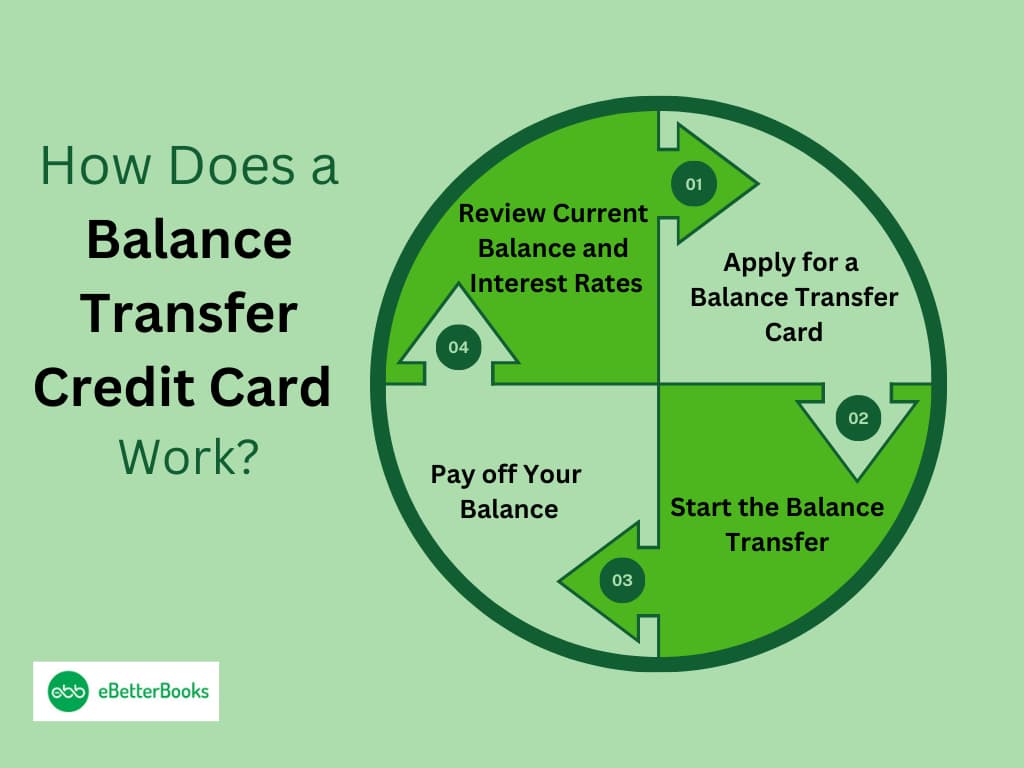

Image Source: EBetterBooks

A balance transfer works best when you take a well-laid-out approach and pay attention to each step. Let’s look at how you can break this down into manageable parts.

Check your current balances and interest rates

The original step starts with checking all your credit card debts. Make a complete list of your balances and their interest rates. This preparation helps you decide which balances you should move first—you’ll want to focus on those with the highest APRs.

Your current APRs appear on recent credit card statements, card terms and conditions, your issuer’s online portal, or through customer service. Note that purchase APRs are different from rates for cash advances or existing balance transfers.

Compare credit card balance transfer offers

Understanding your situation lets you research the right balance transfer options. These key factors matter most:

- Length of the promotional period (ranging from 12 to 21 months)

- Balance transfer fees (typically 3% to 5% of the transferred amount)

- Post-promotional APR (which can range from 17.24% to 29.99%)

- Credit requirements (good to excellent credit scores generally yield better offers)

Cards offering longer 0% introductory periods give you more time to clear your debt without interest, though they might have higher transfer fees.

Apply for the new card and initiate the transfer

Research done, you can now apply for your chosen balance transfer card. Most applications work through online platforms. You’ll need:

- Personal information (name, address, Social Security Number)

- Financial details (income information)

- Information about the accounts you want to transfer from

Approval received; you can start the transfer through your online account, issuer’s mobile app, or phone. Most issuers ask for the account number and transfer amount for each card you’re moving money from.

Track the transfer and continue payments until it completes

Balance transfers take time. Most process in 5-7 days, though some might need 14 days or more. Your old cards still need minimum payments until you see the transfer has gone through.

Your online account usually shows the transfer’s status. The completed transfer will show up as your transferred amount plus any fees on your new card [182].

Make sure your old accounts show a zero balance and no pending transactions before you stop payments. Your new card’s customer service department can help if transfers take longer than 21 days.

What to Watch Out for During the Process

Image Source: Wikipedia

You should watch for these three pitfalls when you make a balance transfer. This will help you avoid unexpected costs and complications.

Balance transfer fees and how they work

Balance transfers typically come with fees that range from 3% to 5% of the transferred amount. A $5,000 transfer with a 3% fee would add $150 to your new balance. The minimum charge for these fees is usually $5 or $10, depending on which is greater. Each transfer you make comes with its own fee.

Some credit unions have cards without transfer fees. Your transfer amount and fee count toward your credit limit. Make sure you leave enough room for the fee when you calculate your transfer amount.

Intro APR period and what happens after

The law requires promotional APR periods to last at least six months, though most cards offer 9 to 21 months. Any remaining balance starts accruing interest at the card’s standard rate once this period ends. The post-promotional rate can jump high—usually between 17% and 29%.

Here’s how to avoid rate shock:

- Figure out how much of your balance you can pay before the promotion ends

- Mark your promotional end date

- Missing a payment could end your promotional rate early

Transfer limits and timing issues

Your credit limit and the issuer’s rules determine your transfer limit. Some issuers limit transfers to 75% of your credit limit. Others might let you transfer up to your full limit minus the fee.

Processing times vary by card issuer. Most transfers take 5-7 days, but some might need 14-21 days or more. Discover makes new accounts wait 14 days before processing transfers. This means new cardholders wait longer than existing customers.

Keep making minimum payments on your old cards while your transfer is pending to avoid late fees.

How to Maximize Savings After the Transfer

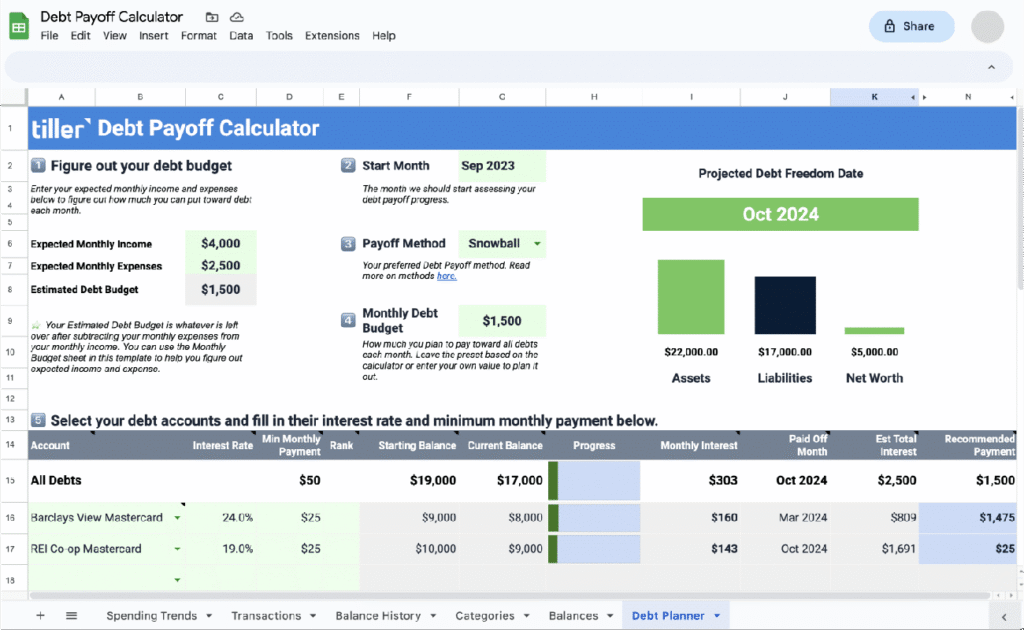

Image Source: Tiller Money

Your debt reduction trip starts when you complete a balance transfer. What you do after the transfer will determine your financial future.

Create a payoff plan before the promo ends

You need to calculate the exact monthly payment needed to clear your debt before the 0% period ends. This is the best way to approach it. Take your total transferred balance (including the transfer fee) and divide it by the number of months in your promotional period. Let’s say you have a $5,800 balance and a 15-month promotional period—you’ll need to pay at least $387 monthly to clear the debt.

Setting up automatic payments will give a foolproof way to stay on track with due dates. On top of that, it helps to have a backup plan ready for unexpected costs that could throw off your payoff strategy. Some people find it helpful to make a lump-sum payment near the end of the promotional period to clear any remaining balance.

Avoid new purchases on the transfer card

New purchases on your balance transfer card will disrupt your debt repayment by a lot. They can cause you to lose your grace period. Interest starts adding up right away on new charges unless your card has a promotional 0% APR on purchases too.

Your payments above the minimum usually go toward balances with higher interest rates first. Your transferred balance won’t decrease much until you’ve paid off all new purchases. Therefore, stick to a different credit card—or debit card—for your daily expenses until you’ve cleared the transfer balance.

Decide whether to close or keep old cards

Your credit score might take a hit if you close old cards because it increases your overall credit utilization ratio. Credit utilization makes up 30% of your FICO® Score. Zero balances on open old accounts help keep your utilization percentage lower.

The card might be worth closing if it has a high annual fee or if available credit makes you spend more. A middle ground would be keeping the card but not using it much—maybe just for one recurring payment that you pay right away. This keeps the positive effect on your credit score while stopping new debt from piling up.

Conclusion: Take Control of Your Credit Card Debt

Balance transfers are a powerful way to tackle high-interest credit card debt. In this piece, we’ve seen how moving your balances can save you thousands of dollars. This creates a clear path to financial freedom.

Your success with balance transfers depends on following a well-laid-out plan. The promotional period is a chance to make solid progress on your debt without adding interest. All the same, this window won’t stay open forever. You need a realistic payoff plan ready before the standard APR begins.

Balance transfers have fees between 3% to 5%, but these costs are nowhere near the interest you’ll save over time. On top of that, it makes your financial life simpler when you combine multiple card payments into one. You won’t need to juggle various due dates and minimum payments anymore.

Note that balance transfers work best as a debt elimination tool, not just a quick fix to dodge interest. Make sure you avoid new purchases on your transfer card. Calculate your monthly payments carefully to pay off everything before the promotional period ends.

A balance transfer is just one step in your trip to financial health. With good planning, controlled spending, and steady payments, you can tap into this tool’s potential. This will help cut down your debt load and bring you closer to financial independence.

FAQs

What is a balance transfer, and how does it work?

A balance transfer involves moving debt from one or more high-interest credit cards to a card with a lower interest rate, typically offering a 0% introductory APR for a set period. This allows you to save on interest charges and potentially pay off your debt faster.

How much can I save with a balance transfer?

The savings can be substantial. For example, transferring a $5,000 balance from a card with 20% APR to a 0% APR card could save you about $1,000 in interest over 15 months. However, remember to factor in the balance transfer fee, which is typically 3-5% of the transferred amount.

What should I watch out for when doing a balance transfer?

Be aware of balance transfer fees, which usually range from 3% to 5% of the transferred amount. Also, note the length of the introductory APR period and what the interest rate will be after it ends. Lastly, be mindful of transfer limits and processing times, which can vary between card issuers.

Should I close my old credit cards after a balance transfer?

It’s generally better to keep old credit cards open, as closing them can negatively impact your credit utilization ratio and potentially lower your credit score. However, if the card has a high annual fee or tempts you to overspend, closing it might be the better option.

How can I maximize savings after completing a balance transfer?

Create a payoff plan to clear your debt before the promotional period ends. Avoid making new purchases on the balance transfer card, as these may accrue interest immediately. Set up automatic payments to ensure you never miss a due date, and consider making a lump-sum payment near the end of the promotional period if needed.