Now Reading: How to Invest in AI Startups: A Small Investor’s Guide to Getting Started in 2025

-

01

How to Invest in AI Startups: A Small Investor’s Guide to Getting Started in 2025

How to Invest in AI Startups: A Small Investor’s Guide to Getting Started in 2025

The global AI market is projected to reach $900 billion by 2026. This projection isn’t just impressive – it reshapes our future. AI has earned its nickname as the “electricity of the 21st century.” In this context, understanding how to invest in AI startups becomes crucial for small investors.

The reality paints an interesting picture. OpenAI’s meteoric rise to a $90 billion valuation in eight years stands out, but 90% of startups still fail. Small investors like us need a strategic approach to invest in AI startups, especially as we explore how to invest in AI startups effectively.

The numbers tell a compelling story. Companies are going all-in on AI, with 44% planning major investments. Venture capital funding for generative AI startups reached $1.7 billion in early 2023. Goldman Sachs analysts see AI technologies creating $7 trillion in economic value – approximately 7.3% of global GDP.

Want to explore the exciting world of AI startup investments? This piece will help you understand everything from finding opportunities to evaluating potential investments. Let’s take a closer look at what makes AI startups tick!

Learning how to invest in AI startups is essential for those looking to capitalize on this booming market.

Understand the AI Startup Landscape

Image Source: New Enterprise Associates

AI startups are revolutionizing how technology investments work today. Smart investors need to know what makes these companies special before putting their money in.

What makes AI startups different from other tech startups

AI startups work quite differently from regular tech companies. These businesses tackle extraordinary technical complexity.

Building AI systems goes beyond simple coding – it demands deep knowledge of machine learning, neural networks, and specialized algorithms.

AI businesses need massive amounts of data to train their algorithms properly. This makes them very different from traditional software companies. Their heavy reliance on data creates unique growth challenges that regular tech companies don’t face.

These startups must also deal with important ethical questions. They have to tackle potential biases, transparency problems, and responsible AI development – issues that regular software companies rarely face at such a basic level. This ethical side adds complexity to investment decisions.

Why 2025 is a unique time to invest in AI Startups

The year 2025 marks a crucial point for AI investments. FTI Consulting reports a major shift in investment focus from hardware and models toward inference applications and AI-enabled products and services. Small investors who missed the original infrastructure wave now have fresh opportunities.

The funding numbers in 2025 are breaking records. AI-related companies pulled in an incredible USD 100 billion in 2024 – almost 33% of all global venture funding.

This momentum keeps building in 2025, with AI companies securing USD 5.7 billion just in January, making up 22% of that month’s total funding.

The AI startup market shows signs of maturity now. Private equity firms are putting more money into AI, focusing on applications that improve cost efficiency and deliver predictable results. Small investors can now find more stable AI investments compared to past years.

Types of AI startups: SaaS, infrastructure, applied AI

Knowing the different types of AI startups helps spot the best investment opportunities:

- Core AI companies build technology that makes AI creation or deployment better. These companies create the basic infrastructure that powers all AI applications.

- Application AI startups build tools that help companies use AI for specific tasks. They create solutions for things like customer service, fraud detection, or content generation.

- Industry-specific AI companies use machine learning to solve unique problems in particular fields. These include healthcare (diagnostics, drug discovery), finance (risk assessment, fraud detection), and sustainability (resource management, carbon footprint reduction).

JP Morgan’s analysts break down the AI value chain further to include hardware providers (like Nvidia, ASML, and TSMC), hyperscalers (cloud services like AWS), and AI essentials (companies that support the entire AI ecosystem). Each category comes with its own risk levels and growth potential.

A solid grasp of these differences in the AI startup world will help you make smarter investment choices.

Know What You Need Before You Invest

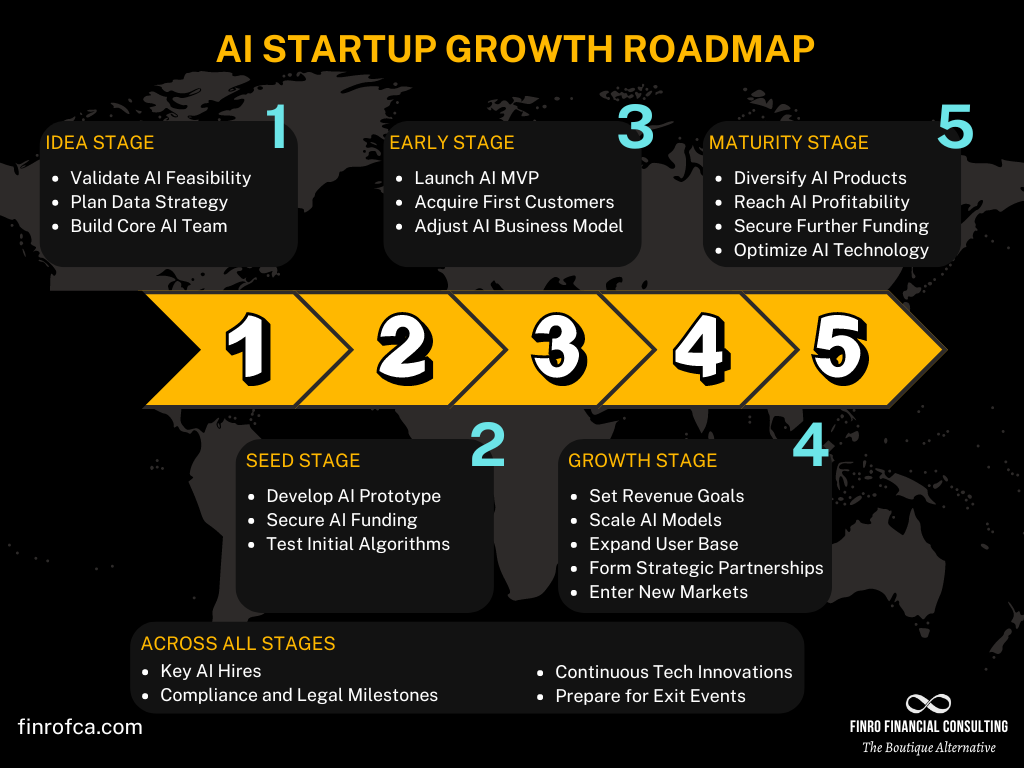

Image Source: Finro Financial Consulting

You need to understand your financial situation before you jump into the exciting world of AI startup investments. Let’s get into what you need to have ready for this investment experience.

Minimum capital and risk tolerance

The AI startup investment world needs you to be clear about your financial position. Angel investors typically put in $50,000 or more per investment in AI startups. If you want to be a limited partner (LP) in a venture capital fund focused on AI, you’ll need even more—usually $1 million plus.

The good news is that new options are becoming available. Regulation Crowdfunding (Reg CF) platforms now let you invest with much lower amounts. Some investment groups accept amounts between $5,000 and $25,000.

The risk numbers tell a clear story. About 90% of startups don’t make it, and many close shop within five years. AI startups face even bigger hurdles because they have:

- Development cycles that run longer than regular tech startups

- Much higher costs to develop products

- Big operational support needs

- Teams that need rare technical skills

This is why you need a portfolio strategy—seasoned investors know that only 10-20% of early-stage investments bring most returns. You might want to spread smaller investments ($5,000-$25,000) across several AI startups instead of putting all your money in one place.

Accredited vs. non-accredited investor status

Your investment options depend heavily on your investor classification. The SEC says accredited investors must meet these financial or professional requirements:

- $1 million net worth (not counting your home), alone or with spouse/partner

- Yearly income above $200,000 alone or $300,000 with spouse/partner for two years running, with good reason to think it’ll stay there

- Special professional licenses like Series 7, 65, or 82

Being accredited opens more private investment doors. These investors can join 3(c)(1) funds that take up to 100 investors (or 250 for funds under $10 million).

Non-accredited investors have fewer options but can still use platforms built just for them. Rules keep changing to give more people access while protecting their interests.

Time horizon and liquidity expectations

AI investments need time to grow. Most investors wait 7-10 years to see returns. Unlike stocks you can trade daily, startup investments stay locked up until there’s an exit.

IPOs remain the key way venture capital works, giving investors a chance to cash out and reinvest. While 2024 was quiet for IPOs, experts predict more companies will go public in 2025.

Not everyone can wait years for possible returns. AI startups need lots of money to grow—some use up to 80% of their early funding just on computing power. Sequoia Capital found that AI companies spent about $50 billion on NVIDIA chips in 2023 but made only $3 billion in revenue.

Small investors should plan carefully. Make sure you won’t need this money soon and keep some extra funds ready to invest more in your best-performing companies.

Where to Find AI Startup Investment Opportunities

Small investors need to know the right places to find promising AI startup investments. The AI market in 2025 offers more ways than ever to get involved, with several viable options to consider.

Equity crowdfunding platforms for AI startups

Regulation Crowdfunding (Reg CF) has created new opportunities for eligible investors to join AI startup fundraising with lower minimum investments. StartEngine and similar platforms make AI-focused startups available to investors. These platforms create a full picture of potential deals based on investor risk appetite and return expectations.

Many AI companies have successfully raised capital through equity crowdfunding. To name just one example, Humanity utilizes AI to help users monitor aging processes, AI Box provides no-code platforms for building AI applications, and Artly combines AI with robotics to create gourmet coffee-making bots. These examples show the variety of applications that attract small investor funding in 2025.

Angel syndicates and online deal networks

Angel investing provides another path where investors can fund early-stage AI startups in exchange for equity or convertible debt. Platforms like AngelList and FundersClub help investors find and evaluate AI startups.

AngelList syndicates let investors team up with experienced leaders, making it easier for newcomers to get started. These syndicates often get first access to new deals. Flucas Ventures, Flight.VC, and Duro Ventures emerged as popular choices for AI investment opportunities in 2024.

AI Angels, a specialized angel network, invests in more than 40 companies with average investments of $45,000. The network’s individual angels often specialize in specific AI sectors like developer tools or enterprise SaaS.

Startup accelerators and demo days

Demo days from prestigious accelerators give investors direct access to promising AI startups. Google’s AI-First Accelerator runs 10-week programs where founders collaborate with Google experts on technical challenges. These programs conclude with demo days where startups present to potential investors.

The landscape includes other notable programs:

- 500 Global Flagship Accelerator hosts exclusive demo days for accredited investors

- Paddle AI Launchpad runs virtual demo days featuring pitches from their latest cohort

- NVIDIA Inception links eligible AI startups with its global ecosystem of VC investors

These programs help investors by vetting startups thoroughly. Top accelerators accept only the most promising candidates through strict selection processes. Investors who attend these events – in person or virtually – can find AI startups before they reach broader markets.

How to Evaluate an AI Startup Before Investing

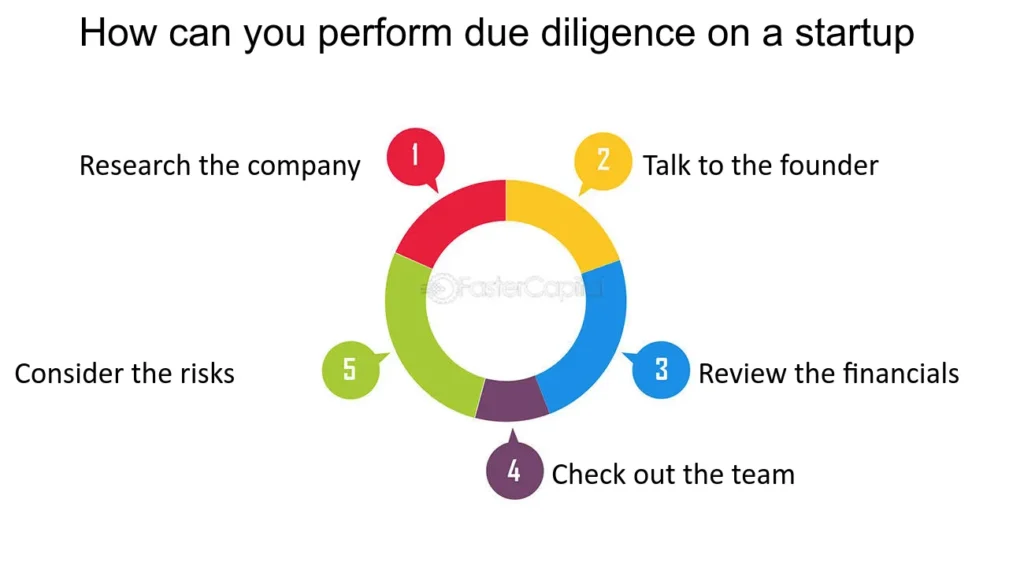

Image Source: FasterCapital

Thorough evaluation serves as the lifeblood of successful AI startup investing. My capital commitment depends on a careful assessment of potential investment opportunities.

Assessing the founding team and technical expertise

The founding team deserves my first look since this is “probably the single most important component of an early-stage startup.” Deep industry expertise combined with AI knowledge and balanced management structures catches my attention. Teams with PhDs often have an edge in AI development, though this doesn’t guarantee success.

The ideal scenario shows complementary skills across technology, sales, marketing, and finance. Technical backgrounds—particularly machine learning expertise—need special focus. A dedicated AI maintenance team plays a vital role because models need ongoing care and updates.

Understanding the AI product and its market fit

The actual AI product evaluation helps determine if it solves real problems or just rides the AI hype wave. The key question remains: “If you removed mentions of AI from the startup’s pitch, would it still be a strong business?”

My analysis breaks down whether the company has:

- A well-defined market with strong demand

- High-quality, legally obtained training data

- Adaptable infrastructure to support growth

- A product that truly needs AI versus conventional solutions

Product-market fit makes all the difference—AI startups should show that customers actively seek their solution. The startup must state how their AI technology handles specific pain points better than existing alternatives.

Red flags to watch for in early-stage companies

Some warning signs need immediate attention. My focus stays on:

- Excessive hype with unproven comparative claims

- Inadequate rights to training data or output

- Poor AI governance frameworks

- Ownership uncertainty regarding AI models and algorithms

- Over-reliance on third-party foundation models without proper licensing

- Limited transparency during due diligence

- Constantly changing vision or business focus

The startup’s approach to regulatory issues and ethical AI considerations needs careful review, especially in sensitive sectors like healthcare and finance. A legitimate AI company shows realistic revenue projections rather than promising unreachable returns.

Making Your First Investment Step-by-Step

You’ve found and assessed a promising AI startup, and now it’s time to make your first investment. Let’s get into the practical steps to finalize your decision and manage your investment going forward.

How to read a SAFE or convertible note

The right investment instrument is a vital part of investing in AI startups. Most early-stage investments use either convertible notes or Simple Agreements for Future Equity (SAFEs).

Convertible notes work as short-term debt instruments that convert into equity at a future funding round. These notes include:

- Interest rates that add up over time and increase your eventual equity stake

- Maturity dates that set deadlines for conversion or repayment

- Valuation caps and/or conversion discounts that give you better terms

SAFEs give you a simpler way forward since they aren’t debt instruments. They don’t have interest rates or maturity dates, which makes them faster to execute and more founder-friendly. Post-money SAFEs show ownership more clearly by calculating conversion based on the company’s capitalization right before the priced round.

Funding your investment account

Your first step is to check which funding methods your chosen platform accepts. Equity crowdfunding platforms usually take bank transfers or wire transfers. Angel networks will give you specific instructions to fund through their syndicate structure.

The next step involves completing any needed accreditation checks, which might need financial documents. You should also set aside extra capital—about 20% of your initial investment—to cover potential follow-on opportunities.

Tracking your investment post-funding

Keep well-organized records of all your investment documents after investing. Many investors now use specialized portfolio tracking tools that combine information about startup investments, valuations, and key milestones.

Build communication channels with founders to get regular updates. Regular progress reports show good signs, while silence could mean trouble ahead.

The long game matters here—AI startup investments usually take 7-10 years to mature. Build relationships with other investors in your syndicate or platform to learn about and access future opportunities together.

Check This Also: How Much Do Insurance Agents Make in 2025? Real Salary Data Revealed

Conclusion

AI startup investing creates amazing opportunities for small investors like us, but success depends on careful planning and smart strategy. The AI world spans from core infrastructure companies to industry-specific applications that help us spot promising investment targets.

The path to success in AI startups needs more than innovative technology. You should get a full picture of founding teams, market fit, and warning signs before putting in your money. On top of that, you need realistic expectations about timing and access to your invested capital.

The risks are substantial, but you can start small through equity crowdfunding platforms or angel groups. Your risk management improves when you build a portfolio in different AI sectors while aiming for better returns.

Note that the best AI startup investments combine solid research, patient capital, and constant learning. You can begin your investment experience today with your available resources, but only invest what you can afford to lose. As AI continues to revolutionize industries, smart investments in promising startups could create lasting value.

FAQs

Q1. What is the minimum amount needed to invest in AI startups? The minimum investment can vary widely. While some angel investments may require $50,000 or more, crowdfunding platforms and syndicates often allow investments starting from $5,000 to $25,000. It’s important to research different options and choose one that aligns with your financial capacity.

Q2. How long should I expect to wait before seeing returns on my AI startup investment? Typically, you should be prepared for a 7-10 year investment horizon. AI startups often require substantial time for development and scaling before reaching an exit event like an acquisition or IPO. It’s crucial to have patience and not expect quick returns.

Q3. What are the key factors to consider when evaluating an AI startup for investment? Key factors include the founding team’s expertise, the AI product’s market fit, the quality of training data, scalable infrastructure, and a clear problem-solving approach. Also, look for realistic revenue projections and proper AI governance frameworks.

Q4. Where can small investors find AI startup investment opportunities? Small investors can explore equity crowdfunding platforms, join angel syndicates, participate in online deal networks, and attend startup accelerator demo days. Platforms like StartEngine and AngelList and events by accelerators like Google’s AI-First program offer various opportunities.

Q5. What are some red flags to watch out for when investing in AI startups? Be cautious of excessive hype without substance, inadequate rights to training data, poor AI governance, unclear ownership of AI models, over-reliance on third-party models without proper licensing, limited transparency during due diligence, and frequently changing business focus. These could indicate potential issues with the startup.