Now Reading: How to Handle Student Loans While Living Abroad: A 5-Year Survival Guide

-

01

How to Handle Student Loans While Living Abroad: A 5-Year Survival Guide

How to Handle Student Loans While Living Abroad: A 5-Year Survival Guide

The numbers are staggering – 43.6 million Americans carry student loan debt, with each person owing around $40,499 on average.

Most people dream of seeing the world, but that massive $1.766 trillion in total student debt keeps them grounded. The good news? Living abroad could help you better manage your student loans. The Foreign Earned Income Exclusion lets you exclude up to $120,000 of your foreign earnings from taxable income in 2023.

Success stories pop up everywhere. Some travelers pay just $20 monthly through income-driven repayment plans. Others travel the world despite having $60,000 in combined student debt. Living abroad can even qualify some borrowers for $0 monthly payments.

This detailed 5-year guide will show you how to handle student loans while living abroad. You’ll learn everything from payment setup to legal strategies that could reduce your payments. Your dreams of teaching in Asia or working remotely from Europe can become reality – student debt doesn’t have to hold you back.

Year 1: Preparing to Move and Setting Up Your Loans

Image Source: International Citizens Group

Planning an international adventure? You need to know how to manage your student loans first. The first year will make or break your financial stability abroad. Setting up the right systems now will make your financial life much simpler.

Understand your loan type: federal vs. private

You should know whether you have federal or private student loans because each type comes with different terms and protections. Federal student loans are the foundations of student borrowing. They offer more borrower-friendly features with lower interest rates and flexible repayment options. The U.S. government backs these loans and provides better protection to overseas residents.

Private loans work differently. Their terms change based on your creditworthiness. Federal loans give you more advantages when you move abroad because of their borrower protections and income-based repayment options.

The U.S. government has several ways to collect if you ignore your federal student loans after moving overseas. They can take your wages from U.S.-based companies, grab your Social Security benefits, and claim future tax refunds. Your credit score will take a hit for up to seven years if you miss payments on federal or private loans.

Apply for income-driven repayment before leaving

The quickest way to protect yourself is to apply for an income-driven repayment (IDR) plan before you leave. These plans look at your income and family size to calculate monthly payments instead of your total debt.

U.S. citizens living abroad get a great advantage with IDR plans and the Foreign Earned Income Exclusion (FEIE). The IRS lets you exclude foreign earnings from your gross income on U.S. taxes through FEIE. Your monthly payments could drop to $0.00 because IDR plans use your adjusted gross income (AGI).

Here’s how to apply for an IDR plan:

- Fill out the online application in about 10 minutes

- Submit your income documents

- File separate requests with each loan servicer if you have multiple ones

You can apply for an IDR plan anytime your financial situation changes while living abroad.

Set up auto-pay and online access to your loan servicer

Auto-payments are a vital part of staying current on your loans. Most student loan servicers want payments from U.S. bank accounts or U.S.-based funds. You should keep your American bank account active after moving overseas.

Auto-pay gives you these benefits:

- Your payments stay on time no matter where you live

- Many servicers cut your interest rate (usually by 0.25%)

- You avoid missing payments because of mail delays or time zones

Let your loan servicer know your new foreign address and phone number before you leave . This way, you’ll get important updates about your account that might affect your payments.

Check if your bank has international branches or charges foreign transaction fees before you go. Sometimes you’ll need regular wire transfers or online money transfer services to keep money in your U.S. account.

Year 2: Earning Abroad and Lowering Your Payments

Image Source: Greenback Expat Tax Services

You’ll find powerful ways to reduce your student loan payments after spending your first year abroad. The time has come to use tax benefits created for Americans who live overseas.

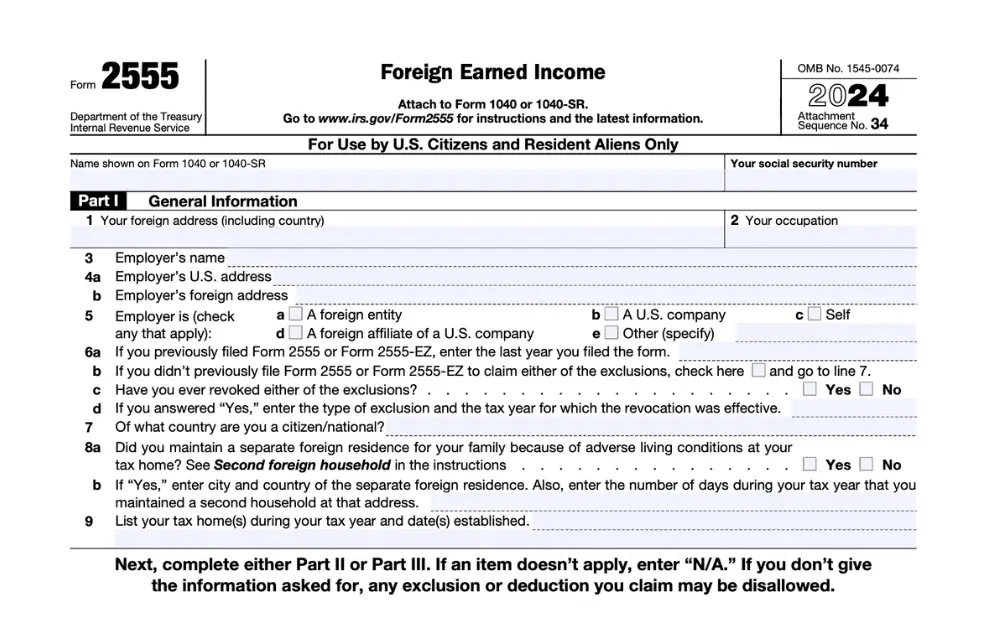

Use the Foreign Earned Income Exclusion (FEIE)

The Foreign Earned Income Exclusion is a game-changing tax provision that helps Americans abroad with student loans. This IRS benefit lets eligible expats exclude much of their foreign-earned income from U.S. taxation—up to $120,000 for 2023 and $126,500 for 2024. Married couples can double this exclusion if they both qualify.

You must meet one of these tests to qualify for the FEIE:

- Physical Presence Test: Stay in a foreign country for at least 330 full days during any consecutive 12-month period

- Bona Fide Residence Test: Show that you’re a bona fide resident of a foreign country for an uninterrupted period including an entire tax year

The best part comes when you combine FEIE with income-driven repayment plans. Your monthly student loan payments go down as your adjusted gross income (AGI) decreases—sometimes all the way to zero.

How to report $0 AGI legally

You need to report your worldwide income on U.S. taxes but can exclude foreign earnings up to the annual limit using Form 2555. This exclusion cuts your AGI—the number that determines your monthly loan payments.

To name just one example, see how earning $100,000 while living overseas could bring your reported AGI down to $0 for student loan purposes. This reduced AGI might drop your payment to as little as $0 per month when you recertify your income for your IDR plan.

Note that timing plays a crucial role. Arrange your tax filing with your yearly IDR recertification so your loan servicer uses your FEIE-reduced income. Keep your documentation ready in case your servicer asks for proof of income.

Avoiding common tax filing mistakes

Tax filing errors can get pricey and affect your student loan strategy if you’re living abroad. The most common mistake happens when people don’t file Form 2555 with their U.S. tax return. You must file to claim the FEIE benefit even if your income falls below the exclusion amount.

There’s another reason people pay too much – not using the Foreign Tax Credit (FTC) with FEIE. The FTC helps reduce your U.S. tax liability on income that exceeds the FEIE limit.

On top of that, it helps to know about these valuable deductions that can lower your taxable income:

- Student loan interest (up to $2,500 annually)

- Housing expenses (potentially up to 30% of FEIE)

- IRA contributions

Don’t just report your net income after the exclusion. Report your full gross income along with the exclusion to avoid double taxation.

These tax strategies in your second year abroad will help cut your student loan burden while you work toward potential loan forgiveness.

Year 3: Living Smart and Paying Less

Your student loan management becomes a vital part of life by your third year abroad. Smart choices about where and how you live can help you keep payments low while you make the most of your time overseas.

Choose low-cost countries to stretch your income

Where you live makes a huge difference in handling student loans abroad. Countries with good exchange rates and cheap living costs can help you save big. A couple can live well in Colombia for just $1,500 monthly. Life in Vietnam costs even less at $1,200 monthly.

Here are some budget-friendly places to live:

- Thailand and Mexico have great areas where rent starts at $600 monthly

- The Philippines and South Africa offer amazingly low costs of living

- Indonesia’s Yogyakarta is 37% cheaper than Jakarta

- You can rent one-bedroom villas near Bali’s beaches for about $1,325 monthly

English teachers in Asia and Persian Gulf countries usually save 30%-50% of their salary after expenses. These regions work great for paying off loans faster.

Live outside major cities to save on rent

After picking your country, look beyond the big cities. The secret to affordable living abroad is simple – stay away from metropolitan areas. Smaller towns and suburbs offer much cheaper housing and often a more authentic experience.

Rent drops by 30-50% when you live outside major cities. You can save even more by sharing a place with other expats or locals. Working as an au pair lets you live rent-free.

Getting around by public transport, walking, or biking saves money. These options help you experience your new country better too.

Use side gigs to cover loan payments

Extra income streams can take care of your loan payments completely. Online English teaching works really well – you just need good internet. This job fits almost anywhere you choose to live.

Freelancing gives you flexible hours and remote work options. Teaching English to local kids brings in steady extra money too.

You can earn more through ride-sharing, pet-sitting, or doing tasks on platforms like TaskRabbit. Put all your side gig money toward loans, and you’ll see your debt shrink faster.

Year three abroad gets easier when you mix smart location picks with careful living choices and extra work. This approach lets you handle student loans while having an amazing international experience.

Year 4: Planning for Forgiveness or Payoff

Your fourth year abroad marks the perfect time to plan your long-term student loan strategy. You’ve spent 3 years overseas and can now start scrutinizing your path toward loan forgiveness or complete payoff.

Track your IDR progress toward forgiveness

The Education Department launched a long-awaited student loan forgiveness tracking feature for income-driven repayment plans in 2025. This tool helps you see specific details about your progress toward loan forgiveness. Your StudentAid.gov account shows:

- Your current number of qualifying IDR payments

- A projected loan forgiveness date

- A month-by-month breakdown of your progress

You’ll need 240 qualifying payments for 20-year IDR terms, while 25-year terms need 300 payments. In fact, keeping records of your progress matters a lot. Take screenshots or convert these pages to PDF files yearly.

Should you refinance your student loans?

Refinancing might give you lower interest rates, but expats should think about this carefully. Private refinanced loans don’t qualify for income-driven repayment plans, unlike federal loans.

Refinancing permanently turns your federal loans into private ones. This removes protections like income-driven repayment and potential loan forgiveness. In spite of that, some lenders work with expatriates who have a U.S. residence or a stateside cosigner.

How to prepare for the tax bomb on forgiven loans

Student loans forgiven after 20-25 years of IDR payments might create a substantial tax liability. The American Rescue Plan made student loan forgiveness tax-free through December 31, 2025. The “tax bomb” returns after this date.

StudentAid.gov‘s Loan Simulator helps you estimate your projected loan forgiveness amount. Save strategically – putting aside $50 monthly could help offset your future tax bill. A Roth IRA that lets you withdraw contributions without penalties could be another option.

Year 5: Returning Home or Staying Abroad

Your fifth year abroad is a turning point in your student loan trip. You might be thinking about coming back to the States or making your overseas life permanent. Now is the time to review your next steps.

What happens if you return to the U.S.?

Coming back to the U.S. after using the Foreign Earned Income Exclusion (FEIE) will affect your student loan situation by a lot. You’ll lose FEIE benefits that kept your adjusted gross income lower once you become a U.S. resident again. So your income-driven repayment amounts will go up, which might shock you when you see the payments.

Your credit score matters again when you return. Missing payments while abroad could hurt your chances to rent apartments, get loans, or even land jobs. Your loan balance might be much bigger than when you left if your loans gathered substantial interest during low- or zero-dollar payment periods.

How to maintain low payments if you stay abroad

Planning to stay overseas? You can keep qualifying for the FEIE by meeting either the Physical Presence Test or Bona Fide Residence Test each year. This helps you keep your potentially low or zero-dollar payments while working toward loan forgiveness.

You still need to keep detailed records. Document all your foreign-earned income and days spent abroad to validate your tax eligibility. It also helps to update your loan servicer about your income and recertify yearly for income-driven repayment plans to keep your payment amounts right.

Reassess your financial goals and loan strategy

The FEIE approach has few risks if you plan to stay overseas for the long haul, but think about your retirement planning too. Some expats find it hard to put money into retirement accounts like Roth IRAs while using this strategy.

Note that any forgiven loan amount becomes taxable income during your review. This “tax bomb” means you’ll pay income tax on all the forgiven amount in one year. You can avoid financial stress when forgiveness happens by saving strategically for this future tax bill.

You might head home or continue your international life. Either way, regular reviews of your financial situation with an experienced expat financial advisor will help keep your student loan strategy in line with your changing life goals.

Conclusion

Managing student loans while living abroad demands careful planning and smart decisions. Your loan type, income-driven repayment plans, and the Foreign Earned Income Exclusion can help you achieve your international dreams. These tools keep your loan payments manageable.

Your choice of location and income sources significantly impacts loan management success. You can create a stable financial situation abroad by choosing affordable countries and areas outside major cities. Additional income streams through side gigs also strengthen your financial position.

Your long-term strategy plays a crucial role, whether you pursue loan forgiveness through IDR plans or aim for complete payoff. You can stay on track with your chosen path through regular progress checks and detailed record-keeping. Understanding potential tax implications helps you prepare better.

Thousands of Americans handle their student loans successfully while living overseas. Consistent loan monitoring, proper documentation maintenance, and knowledge of repayment options will help you achieve both your travel aspirations and financial objectives.

FAQs

Q1. Can I still manage my student loans if I move abroad? Yes, you can manage your student loans while living abroad. It’s important to understand your loan type, set up income-driven repayment plans, and maintain communication with your loan servicer. You may even be able to lower your payments by using the Foreign Earned Income Exclusion.

Q2. Do I have to continue making student loan payments while living overseas? Yes, you are still responsible for your student loan payments when living abroad. However, you may be able to reduce your payments by enrolling in an income-driven repayment plan and utilizing the Foreign Earned Income Exclusion, which could potentially lower your payments to as little as $0 per month.

Q3. How can I minimize my student loan payments while living in another country? You can minimize your payments by choosing to live in low-cost countries, residing outside major cities to save on rent, and using side gigs to cover loan payments. Additionally, applying for income-driven repayment plans and leveraging the Foreign Earned Income Exclusion can significantly reduce your monthly obligations.

Q4. What happens to my credit score if I move abroad with student loans? Your U.S. credit score won’t transfer to your new country, but it’s still important to maintain good standing on your loans. Missing payments can damage your U.S. credit score, which could affect you if you decide to return. It’s crucial to keep making payments and communicate with your loan servicer while abroad.

Q5. Should I refinance my student loans before moving overseas? Refinancing your student loans before moving abroad requires careful consideration. While it might offer lower interest rates, it also converts federal loans to private loans, eliminating protections like income-driven repayment plans and potential loan forgiveness. It’s generally advisable to maintain federal loan status when living abroad for more flexible repayment options.