Now Reading: PPO vs Other Health Plans: How to Make the Best Choice for Your Family

-

01

PPO vs Other Health Plans: How to Make the Best Choice for Your Family

PPO vs Other Health Plans: How to Make the Best Choice for Your Family

Did you know what PPO stands for in health plans? It’s a “preferred provider” organization—and it’s the most common health plan in America. The numbers show that 46% of the roughly 153 million Americans with employer-sponsored health coverage choose this option.

PPO insurance gives you more flexibility to choose healthcare providers without needing referrals for specialists. This freedom sounds great but comes with higher costs. The average employer-sponsored PPO plan in 2023 runs about $8,906 per year for individuals and $25,228 for family coverage. HMO plans cost less at $8,203 for individuals and $23,758 for families. The difference between PPO and HMO insurance is a vital consideration since it boils down to balancing flexibility with cost.

The PPO system lets you visit providers outside your network – something most other plans don’t allow. You’ll save money by staying within your PPO network, though. Many families pick PPO plans because of this flexibility, even with higher premiums. Your family’s choice depends on your healthcare needs, budget, and lifestyle priorities.

Let’s help you find a health insurance plan that protects your family and fits your budget.

Start with Your Family’s Health Needs

Your family’s specific healthcare needs are the foundations of making a smart health insurance choice. Understanding your unique medical situation helps you choose between PPO insurance and other plan types.

Look at how often your family visits healthcare providers. A PPO plan might be your best choice if you or your loved ones need regular specialist visits for chronic conditions. PPO stands for Preferred Provider Organization, and it lets you see specialists without getting referrals from primary care physicians.

Your family’s medications are another key factor. Different plans have varying levels of prescription coverage. This becomes especially important when comparing PPO vs HMO insurance options for families who need multiple prescriptions.

Your relationship with current doctors matters too. Check if your trusted healthcare providers participate in the networks of plans you want. PPO plans give you access to larger provider networks and let you see out-of-network doctors at higher costs.

Think about your family’s history with specialist care. Have you needed orthopedists, dermatologists, or other specialists before? PPO plans shine here because they offer direct specialist access without gatekeeper requirements.

Your family’s life stage and predicted health events should shape your decision. Major medical events like pregnancies or planned surgeries need careful consideration.

Past healthcare patterns tell the full picture of your needs. Look at your previous medical appointments, hospital visits, and unexpected health issues. This history shows what your family needs from health insurance.

This self-assessment helps you decide if a PPO or another plan type best fits your family’s healthcare needs.

Compare Plan Types Based on Lifestyle

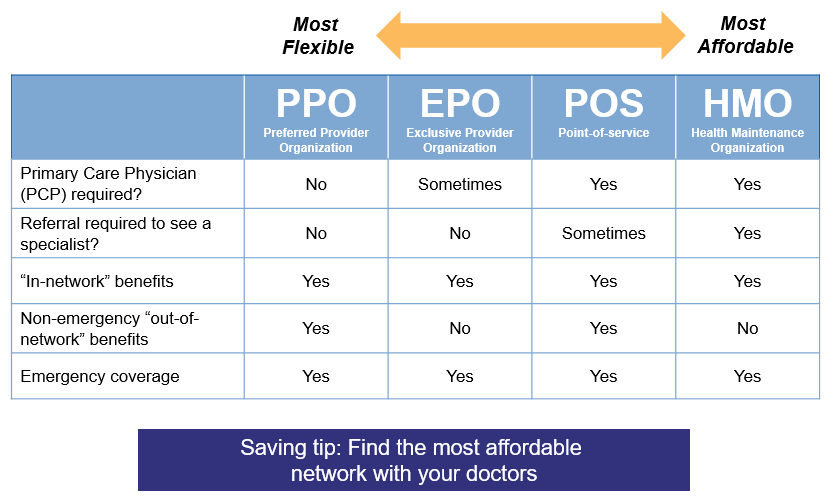

Image Source: Mabel Wadsworth Center

Your family’s lifestyle is a vital part of choosing the right health plan. Each plan structure fits different living patterns and priorities, especially if you want to understand what PPO means in health insurance compared to other options.

PPO insurance gives great advantages to people who travel often. A Preferred Provider Organization has nationwide networks, so you can find in-network providers even when you’re away from home. HMO plans, on the other hand, only cover care in specific areas, which doesn’t work well for families on the move.

The plans differ greatly in how much choice you get. PPO plans let you see specialists without referrals, which saves time by cutting out extra appointments. These plans also let you visit any provider—even outside your network—but at higher costs. This works great for families with busy schedules or those who don’t want to stick to just one primary care doctor.

HMOs are a great choice if saving money matters more than flexibility. These plans have lower monthly premiums ($8,203 for individuals and $23,758 for families, while PPOs cost $8,906 and $25,228). But these savings come with limits—you need a primary care doctor and referrals to see specialists.

EPO plans strike a balance between these choices. Just like PPOs, you don’t need referrals to see specialists. In spite of that, they only cover in-network care except during emergencies. You’ll pay less than with PPO plans but get more provider options than HMOs.

POS plans might work best if your family needs coordinated care with occasional out-of-network services. These plans mix HMO coordination with some out-of-network coverage, though it costs more.

Here’s how different plans match different lifestyles:

- Remote workers/frequent travelers: PPO gives you coverage wherever you go

- Budget-conscious families with local doctors: HMO helps you save money

- Families who want specialist access without referrals but stay in-network: EPO balances cost and ease

- Families needing coordinated care with some out-of-network visits: POS gives structure with flexibility

Cost vs Flexibility: What Matters More?

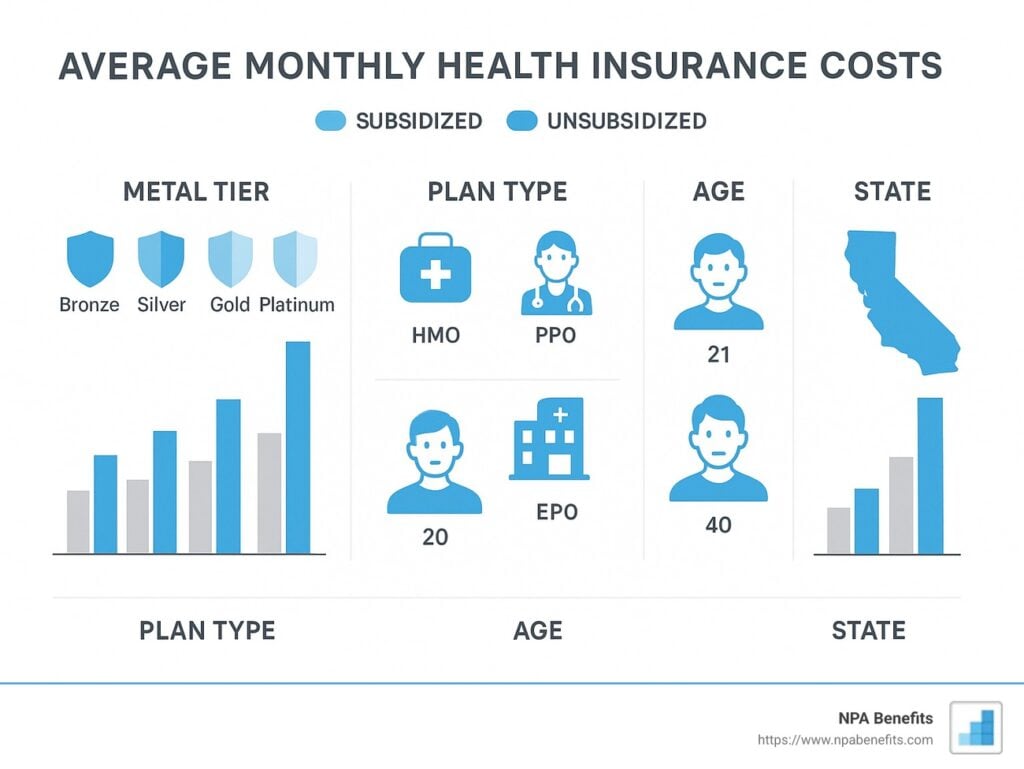

Image Source: NPA Benefits

The biggest challenge in picking health insurance comes down to a simple question: would you rather pay more to freely choose your healthcare providers?

PPO plans cost more than other options at the time we analyzed the numbers. An employer-sponsored PPO policy costs $8,906 per year for individuals, while HMOs cost $8,203. Family coverage shows an even bigger gap – $25,228 for PPO versus $23,758 for HMO plans. This means you’ll pay about $1,000 more each year with a PPO compared to similar plans.

PPO plans need you to meet separate deductibles for in-network and out-of-network care before coverage kicks in. To name just one example, a broken arm costing $850 comes straight from your pocket if you haven’t met your $2,000 network deductible yet.

So what makes people choose the more expensive option? The answer lies in the flexibility that PPO health insurance provides:

- You can see specialists without referrals

- You have the choice to visit out-of-network providers (at higher costs)

- No need to pick a primary care doctor

- Access to bigger, nationwide provider networks

Your choice really depends on what matters most to you. A PPO plan might make sense if you can handle higher costs and value provider choice. Budget-conscious people might prefer an HMO’s lower out-of-pocket costs and monthly premiums.

The balance between cost and flexibility changes based on your family’s situation. Families who need specialist care or frequent hospital visits might find a PPO’s flexibility worth the extra cost. The right choice comes down to whether you want to pay more for healthcare freedom or save money with more structured care.

Conclusion

Your choice of health insurance plan ended up being about finding the right balance between your family’s healthcare needs and costs. PPOs give you more flexibility and provider choice but cost more. HMOs are cheaper but limit your network options. EPO and POS plans sit in the middle, each with their own benefits based on your situation.

Your family’s unique healthcare needs, lifestyle, and budget should drive this decision. The extra cost of a PPO makes sense if you travel a lot or need to see specialists without referrals. An HMO’s lower premiums might work better if you have trusted local doctors and your healthcare needs are stable.

Take time to really look at how your family has used healthcare in the last few years. It also helps to think about any predicted medical needs coming up, like planned surgeries or specialist visits. Looking at both past patterns and future needs will point you toward the right choice.

The right plan isn’t always the most expensive or cheapest option. You need coverage that matches your family’s healthcare needs and fits your budget. Make this choice carefully by weighing both the money and healthcare aspects to protect your family without straining your finances.

FAQs

Q1. Which health plan is better for families: HMO or PPO? The best plan depends on your family’s specific needs. HMOs typically offer lower costs and coordinated care, while PPOs provide more flexibility in choosing healthcare providers. Consider your budget, preferred doctors, and healthcare requirements when making a decision.

Q2. What are the main disadvantages of a PPO plan? PPO plans generally have higher premiums and out-of-pocket costs. They also require more complex management, as there’s less coordination of care without a primary care physician overseeing your healthcare needs.

Q3. Why might someone choose a PPO over an HMO? People often choose PPOs for their larger networks, ability to see specialists without referrals, and coverage for out-of-network care. This flexibility is particularly beneficial for those who travel frequently or have specific healthcare provider preferences.

Q4. How do PPO costs compare to other health plans? PPO plans typically have higher premiums than other plan types. On average, PPO plans cost about $1,000 more annually than comparable plans. However, they offer more flexibility in choosing healthcare providers and services.

Q5. What factors should I consider when choosing between different health plans? Consider your family’s healthcare needs, budget, preferred doctors, frequency of specialist visits, and lifestyle (e.g., travel habits). Also, evaluate your past healthcare usage and any anticipated medical needs in the coming year to determine which plan type offers the best balance of coverage and cost for your situation.

![Does Credit Score Affect Insurance Rates? Expert Analysis [2025 Guide] 4 Credit Score Affect Insurance Rates](https://finance.news4social.com/wp-content/uploads/2025/04/ff3af95f-13e4-4294-adb7-d13fec10f8b4-1024x585.png)