Now Reading: How can I verify if a loan offer is genuine or a scam ?

-

01

How can I verify if a loan offer is genuine or a scam ?

How can I verify if a loan offer is genuine or a scam ?

Americans lost over $12.5 billion dollars to loan scams and fraudulent practices in 2024, according to the Federal Trade Commission. The losses have skyrocketed from $1.9 billion in 2019. These numbers show an alarming trend that keeps growing.

Scammers prey on business owners and people who need quick cash or struggle to qualify for traditional loans. They set up fake loan companies or pretend to be legitimate lenders to steal money and personal information. Watch out for red flags like guaranteed approval without credit checks, demands for upfront fees, and aggressive sales tactics that rush you to decide.

Nearly 24 million Americans had a personal loan by mid-2024. This makes it crucial to spot genuine loan offers from scams. This piece will show you common personal loan scams and their warning signs. You’ll learn what steps to take when you spot suspicious offers and how to verify a loan company’s legitimacy before sharing your personal details.

Recognize the Most Common Loan Scams

Image Source: CreditFresh

Looking for financing options might expose you to deceptive schemes designed to steal your money or personal information. You need to understand how these scams work to protect yourself. Let’s get into the most common loan scams you should watch out for.

Advance fee scams

Advance fee scams are one of the most common loan frauds. Scammers pose as legitimate lenders and promise loans with seemingly favorable terms. The Federal Trade Commission received nearly 26,000 reports of people paying scammers an advance payment for credit services in 2023.

The scam works like this: after “approving” your loan application, the fraudster just needs an upfront payment before releasing the funds. These payments are often disguised as

- Processing or application fees

- Insurance on the loan

- Administrative charges

- Deposits or security payments

The scammer disappears without providing the promised loan once you pay these fees. These scams become especially dangerous when fraudsters ask for payment through hard-to-trace methods like wire transfers, cryptocurrency, gift cards, or money orders.

Note that legitimate lenders might charge application or appraisal fees, but they never guarantee loan approval before reviewing your credit history. It’s illegal for telemarketers to promise you a loan or credit and demand payment before delivery.

Fake loan apps and phishing emails

Cybercriminals have adapted their tactics to include sophisticated digital methods. Fake loan applications and phishing schemes target people through social media platforms more frequently now.

Scammers create counterfeit loan apps that copy legitimate financial institutions and promote them through social media ads. These apps ask for sensitive information like bank details, ID cards, and sometimes even selfies with your identification documents. Earlier this year, the Enforcement Directorate cracked down on a massive ₹719 crore loan scam linked to fraudulent loan apps that misused borrowers’ personal data for extortion and harassment.

Phishing scams trick you into providing sensitive information through emails or text messages that seem to come from trusted sources. Scammers send official-looking emails that ask you to fill out forms designed to steal your information for identity theft. These emails often create false urgency by claiming suspicious account activity or payment problems that don’t exist.

On top of that, fraudulent operators send unsolicited loan offers through email, text, or phone calls. These unexpected communications should raise red flags immediately. In Bengaluru, cybercriminals posed as a private company and sent bulk emails offering instant loans, then collected “processing fees” for loans that never materialized.

Scammers constantly adapt their tactics to look more legitimate. They use fake company logos, false caller ID numbers, and other deceptive techniques to impersonate trustworthy financial institutions. So verifying the source of any loan offer before sharing personal information is crucial to protect yourself.

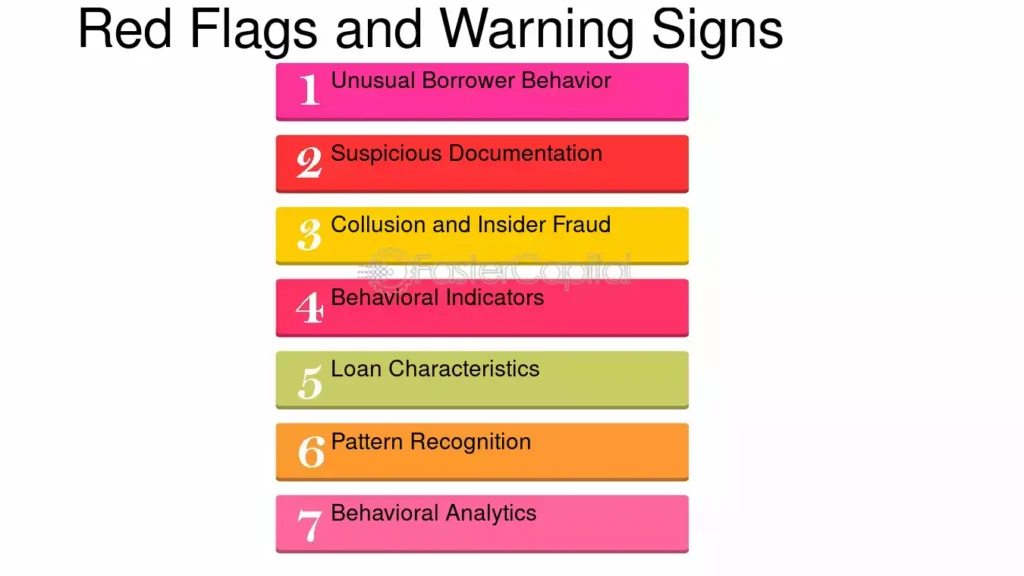

Red Flags That Signal a Scam

Image Source: FasterCapital

You need to know the warning signs to protect yourself from loan scams. Spotting these red flags early can save you from devastating financial losses and identity theft. Let’s get into the signs that should make you pause before accepting a loan offer.

Unsecured websites asking for personal info

Your sensitive information becomes exposed to cybercriminals on unsecured websites. You can quickly spot an unsecure site by looking at the URL – legitimate loan websites use “https://” instead of just “http://” in their web address. The “s” shows the site encrypts your data to keep it safe.

Entering personal information on an unsecured website means your data travels as plain text. This makes it easy for hackers to steal. The risks are serious:

- Cybercriminals can see your personal details

- Hackers redirect your connection to malicious websites

- Attackers can perform “man-in-the-middle” attacks and spy on your data transfers

- Your device might download malicious code without you knowing

The padlock icon in your browser’s address bar serves as another security indicator besides “https://.” This icon confirms proper security certificates are in place. You can click this icon to see detailed information about the site’s security status.

No credit check or guaranteed approval

The promise of guaranteed approval without credit checks stands out as a clear sign of a loan scam. Legitimate lenders assess your financial situation before approving loans. A lender that promises instant approval without checking your creditworthiness likely wants to trap you.

Scammers target people who have poor credit histories or financial troubles. They know these individuals might feel desperate for funding. “Guaranteed loans” or “no credit check required” ads attract vulnerable borrowers who can’t get loans elsewhere.

No-credit-check loans come with major problems, even from legitimate sources:

- Interest rates hit triple digits, with APRs averaging 400% or higher

- Most don’t report to credit bureaus, so your credit score won’t improve

- Borrowers often get stuck in debt cycles

These scammers create fake urgency and pressure you to act fast before you research the company or look at other options. This pressure tactic aims to cloud your judgment so you miss the warning signs.

No physical address or contact info

A legitimate financial institution always lists verifiable contact information and a physical address. Scammers avoid physical addresses to stay anonymous and dodge responsibility. They might only list a PO box or skip the address entirely, making it hard to find them if something goes wrong.

Watch for these address-related warning signs on a lender’s website:

- No physical location listed

- Only a post office box (P.O. Box) shown

- Address doesn’t match state license details

- Strange communication methods, like messaging apps instead of business phones

Note that legitimate lenders must register in every state where they do business. Your state’s attorney general’s office or bank regulator can verify a lender’s license. A lender can’t legally offer you loans without registration in your state.

Unsolicited contact from lenders through phone calls, emails, or texts should raise red flags. Trustworthy lenders use traditional marketing and wait for customers to reach out to them.

How to Respond to a Suspicious Offer

You need to act fast to protect your money and personal information when you spot a suspicious loan offer. Spotting potential loan scams is just the first step—you also need to know what to do next.

Stop communication immediately

Your first move should be to cut off all contact with the suspected fraudster if you think you’re dealing with a loan scam. The Federal Trade Commission (FTC) says you should not respond to any more messages from potential scammers. Any further communication just gives criminals more chances to pressure you or get more information.

Just stop responding to:

- Phone calls and texts

- Emails and social media messages

- Letters or any other messages

You might want to confront the scammer, but this could make things worse or give them more ways to manipulate you.

Do not send any money or documents

Never send money, personal documents, or extra information to someone you suspect is a scammer. This rule applies whatever their story might be. Note that companies cannot legally charge upfront fees to help with loan modifications or relief.

Here’s what to do if you’ve already shared financial information:

- Call your bank or credit card company right away

- Let them know about unauthorized activity

- Ask if they can stop payments or give you a refund

Your bank can often help get your money back, especially if you report the fraud quickly and used a credit or debit card.

Document all interactions

A detailed record of your communications with the suspected scammer will help with any investigation later. These records are vital evidence when you report to authorities and banks.

You should create a documentation file that includes:

- Screenshots of all messages and conversations

- Emails saved in a special folder

- Website URLs and information

- Timeline showing what happened and when

The Cyber Helpline says this evidence is key to helping police or bank investigations. They suggest keeping all this information in a safe place.

A full record increases your chances of getting lost money back and helps authorities build better cases against scammers. This could also stop others from becoming victims.

Report and Recover from a Scam

Image Source: consumer.ftc.gov

Victims of loan scams need to act quickly to minimize financial damage and prevent identity theft. The ordeal creates stress, but a systematic approach to reporting and recovery substantially improves your chances to reclaim lost funds and secure your personal information.

File a report with the FTC and CFPB

Your first step should be reporting the scam to the Federal Trade Commission (FTC) at ReportFraud.ftc.gov, even without recovering your money. The FTC shares reports with over 2,800 law enforcement agencies to detect patterns of wrongdoing that lead to investigations and prosecutions. The FTC cannot resolve individual reports, but your submission helps their enforcement efforts against fraudulent operations.

The next step involves filing a complaint with the Consumer Financial Protection Bureau (CFPB). This government agency regulates consumer financial products and takes action against companies that violate financial laws. These reports create an official record of the whole ordeal and strengthen your case to seek reimbursement.

Contact your bank or credit card company

You should contact your financial institution immediately after noticing unauthorized transactions or sending money to scammers. Tell them what happened and ask for a refund. Your bank should issue a refund for payments sent to UK accounts through Faster Payments or CHAPS. This protection might not apply to BACS, Swift, or wire services like MoneyGram and Western Union.

Your bank’s refusal to return your money means you can file a formal complaint. The case can go to the Financial Ombudsman if eight weeks pass without resolution or you receive a “final response letter”.

Place a fraud alert or credit freeze

Fraud alerts and credit freezes serve as powerful tools to prevent further credit damage. These services come free and won’t affect your credit score.

A fraud alert tells creditors to verify extra steps before approving new credit in your name. Three types exist:

- Initial fraud alerts – Last one year, suitable for anyone concerned about fraud

- Extended fraud alerts – Last seven years, require an identity theft report

- Active duty alerts – For military personnel on deployment

A credit freeze (or security freeze) provides stronger protection by blocking creditors from accessing your credit report until you remove the restriction. Contact any of the three major credit bureaus (Equifax, Experian, or TransUnion) to place either protection, and they will notify the others.

How to Find Legitimate Loan Companies

Image Source: Advance America

Taking charge of your financial safety requires more than avoiding scams – you need to know how to identify trustworthy lenders. A proactive search for legitimate loan companies will protect you from fraud and help you access needed funds.

Apply directly through trusted financial institutions

The safest way to get a loan is to work directly with 50+ year old financial institutions. Banks, credit unions, and prominent online lenders depend on their reputation to stay in business. These institutions must register in every state where they offer loans – a requirement that helps ensure legitimacy.

You should verify the lender’s proper licensing before submitting any application. Most legitimate lenders showcase their state licenses on their websites, and you can verify this information through your state’s attorney general or banking regulator. LightStream, as an example, offers personal loans up to $100,000 for borrowers who need larger amounts.

Physical institutions naturally provide extra security since you can visit their locations. All the same, many trustworthy online lenders deliver excellent service with robust security measures.

Use verified loan marketplaces

Loan marketplaces make your search easier by connecting you with multiple pre-vetted lenders. LendingTree and similar platforms merge with financial institutions to help consumers compare tailored loan offers from multiple verified lenders. These platforms display user ratings based on real customer experiences—LendingTree shows ratings from thousands of verified users per lender.

You should be selective about which marketplaces you trust. Legitimate comparison sites are transparent about their compensation arrangements and perform thorough evaluations of their partner lenders.

Read unbiased reviews and ratings

Research the lender’s reputation through these sources before applying:

- Better Business Bureau (BBB) profiles—check their rating and unresolved complaints

- Third-party review sites like Trustpilot

- Consumer Financial Protection Bureau’s complaint database

- J.D. Power’s annual satisfaction studies

Reviews are a great way to get real customer experiences and reveal problems you might miss on a lender’s website. Note that legitimate lenders usually maintain 4+ star ratings across multiple platforms.

Your friends’ and family’s experiences with specific lenders can provide valuable insights. Personal recommendations often give the most reliable picture of a company’s practices.

Conclusion

Your best defense against loan scams ends up being watchfulness, education, and taking time to evaluate financial offers. In this piece, we got into the alarming rise in loan fraud and the clever tactics scammers use to target people who are vulnerable.

Here’s what you need to know: legitimate lenders never guarantee approval without checking your credit or just need upfront fees before providing services. On top of that, it’s crucial to verify a lender’s credentials through official channels before sharing any personal information. A physical address, proper website security measures, and state licensing are clear signs of legitimacy.

You can still find genuine loan options through long-standing financial institutions and verified loan marketplaces, despite all the scams out there. Your risk of becoming a victim drops substantially when you check unbiased reviews, consult the Better Business Bureau, and research lender reputations.

Quick action is essential if you think you’ve run into a scam. Stop all communication, document everything, and report the whole ordeal to authorities like the FTC and CFPB. Recovering from financial fraud isn’t easy, but acting fast often limits the damage and helps prevent future losses.

Trust your gut when looking at loan offers. Real lenders won’t rush you into quick decisions or ask for unusual payment methods. Taking a few extra minutes to verify a company’s legitimacy can save you thousands of dollars and countless hours of recovery work. Your financial security deserves this level of careful checking.