Now Reading: 15 Best Personal Loans for Bad Credit in April 2025 (500-580 Credit Score)

-

01

15 Best Personal Loans for Bad Credit in April 2025 (500-580 Credit Score)

15 Best Personal Loans for Bad Credit in April 2025 (500-580 Credit Score)

The interest rates on personal loans for bad credit will shock you. Borrowers who have credit scores between 580-619 face an average APR of 116.55%. The rates get even worse for those with scores between 560-579, hitting a staggering average of 168.36%.

The good news? You still have real options even with poor credit. Most lenders on our list work with credit scores down to 580. Some will even work with you if you don’t have any credit history. These bad credit personal loans range from $1,000 to $50,000, and you can pay them back over two to seven years. The right loan can make all the difference in your financial situation, whether you need money to consolidate debt, pay medical bills, or handle emergencies.

We’ve done our homework to find the best loans for bad credit that won’t leave you drowning in debt. Bad-credit borrowers saw an average pre-qualified personal loan rate of 21.64% in February 2025. The best part? Many trusted lenders keep their rates at or below 36%. To cite an instance, see Happy Money – they focus on credit card debt consolidation, and their maximum APR is just 17.48%. This is a big deal as it means that their rates beat most other lenders in this market.

Upstart: Best Overall for Bad Credit Personal Loans

Image Source: Upstart

Upstart distinguishes itself as an AI-powered lending platform that goes beyond traditional credit scores. The platform reviews borrowers using over 1,000 data points that include education and employment history. This makes it a great option for people with poor credit histories.

Upstart loan features and eligibility

Upstart welcomes applications from the entire credit spectrum and works with borrowers who have credit scores as low as 300. The platform has removed the minimum credit score barrier. The company even accepts applicants who don’t have enough credit history to generate a score. You need these qualifications:

- $12,000 yearly income minimum

- Money can come from wages, self-employment, retirement benefits, Social Security, disability benefits, alimony, or child support

- Your credit report must stay stable between getting the rate offer and signing

The platform gives you just two repayment terms – 36 or 60 months. Most competitors offer more choices.

Upstart APR and fees

A look at the costs shows Upstart’s origination fees range from 0% to 12%, among the highest in the market. These rates still stay below what financial experts call predatory for bad credit borrowers.

You can check your rate without hurting your credit score through a soft credit inquiry. The platform runs a hard credit check that will affect your score once you accept the offer and move forward with your application.

Upstart approval process and funding speed

The platform has one of the quickest approval processes you’ll find. Most people get their decision right away after they apply. Approved borrowers can get their money in just one business day.

Your loan agreement signing time matters. Upstart starts the transfer the next business day if you sign before 5:00 PM ET on a business day. Signing later or during weekends might add an extra business day to funding.

The platform reports your payment history to all three major credit bureaus. This means paying on time helps build your credit score, while missing payments hurts it.

Avant: Best for Fast Personal Loans for Bad Credit

Image Source: Finder

Avant stands out by providing quick funding to borrowers with credit challenges. The company positions itself as a budget-friendly alternative to predatory lenders and helps people who need immediate financial help despite their damaged credit.

Avant loan terms and credit requirements

Avant welcomes borrowers with credit scores as low as 550, making it one of the most lenient traditional personal loan lenders. This makes their services available to people with very poor credit ratings. You can borrow $2,000 to $35,000 and repay it over 24 to 60 months.

You’ll need a minimum monthly net income of $1,200 and an active bank account to qualify. The company accepts different types of income. These include your job, alimony, retirement, child support, Social Security payments, and disability benefits.

Avant funding timeline

Quick processing is Avant’s biggest strength. The company reviews applications within minutes and sends money the next business day after approval. When your loan gets approved before 4:30 PM CT Monday through Friday, you’ll see the money in your account the following business day. Most people complete the whole process in just 1-2 business days.

Avant fees and repayment flexibility

The company takes an upfront administration fee of up to 9.99% from your loan amount before sending the money. APRs range from 9.95% to 35.99%, and borrowers with poor credit usually get rates closer to the higher end.

You might also face late fees (which vary by state) and returned payment charges. The good news is you can make extra payments or pay off your loan early without any penalties. If you hit rough patches, Avant might let you postpone payments, stretch out your loan term, or lower your monthly payments temporarily.

While Avant’s rates and fees exceed those of prime lenders, they stay well below payday loan costs. This creates a realistic option for borrowers with credit challenges.

Upgrade: Best for Flexible Repayment Terms

Image Source: Upgrade

Upgrade stands out by offering some of the longest repayment terms in the industry. Borrowers can take up to 84 months (7 years) to pay back personal loans for bad credit. These extended terms help create lower, more manageable monthly payments compared to other lenders.

Upgrade loan options and terms

The platform provides personal loans from $1,000 to $50,000 with payment periods between 24 to 84 months. Borrowers benefit from fixed interest rates that keep their payments stable throughout the loan term. The funds usually arrive within one business day after you sign the loan agreement. The platform charges an origination fee between 1.85% to 9.99%, which comes out of your loan amount before funding.

Upgrade APR discounts and secured loans

You can lower your interest rate through several options:

- Setting up automatic payments gives you a 0.5 percentage point reduction

- Having Upgrade pay your creditors directly offers a 1 to 3 percentage point discount

- Securing your loan with a vehicle can reduce rates by 1 to 10 percentage points

The direct payment discount requires at least half of your loan funds to go toward existing debts. Secured loans accept vehicles up to 20 years old that have clean titles.

Upgrade credit score requirements

You’ll need a minimum credit score of 580 to qualify for an Upgrade personal loan, making it available to borrowers with bad credit. Other requirements include

- One or more accounts on your credit report

- Credit history of at least two years

- Debt-to-income ratio no higher than 75% (including mortgage)

- Active bank account and email address

- U.S. citizenship, permanent residency, or valid visa

- Age requirement of 18 (19 in some states)

In fact, Upgrade excels at providing options for credit-challenged borrowers who need longer-term financing solutions with potential rate advantages.

Best Egg: Best for Secured Loans with Collateral

Image Source: Best Egg

Best Egg stands out by giving homeowners a unique secured loan option that can save borrowers money, especially those who face credit challenges. You can tap into your home’s equity without putting up the whole property as collateral.

Best Egg secured vs. unsecured loans

Best Egg’s secured loans work differently from traditional secured options. These loans don’t need your entire home as collateral. Instead, they put a lien on fixtures that are permanently attached to your home—like built-in cabinets, light fixtures, and bathroom vanities. This helps protect the lender without risking your entire property.

Homeowners can save a lot by choosing the secured option. Best Egg’s secured loans come with an average APR discount of 20% compared to unsecured loans. The secured loans also let you borrow more money. You can get up to $50,000, and the money could be in your account within 24 hours.

The lien goes away automatically once you pay off your loan. Remember that the lien shows up in title searches, which might affect your ability to sell or refinance your home while you’re still paying off the loan.

Best Egg APR and origination fees

The APR savings on Best Egg’s secured loans make a big difference—rates range from 5.99% to 29.99% for secured options. Their unsecured personal loans have higher fixed rates between 7.99% and 35.99%.

Best Egg loans don’t charge prepayment penalties. This means you can pay ahead without extra costs. This feature really helps borrowers who want to rebuild their credit through smart loan management.

Best Egg approval odds for bad credit

Best Egg usually looks for borrowers with credit scores of 640 or higher. However, their secured loan option might work for people with lower scores. Secured loans reduce the lender’s risk through collateral, so credit requirements tend to be more flexible than unsecured loans.

A low debt-to-income ratio boosts your chances of approval. Best Egg looks beyond just your credit history, which makes their secured loans worth a shot even with less-than-perfect credit. They focus on your ability to repay the loan along with your homeownership status and equity position.

You should check if you pre-qualify before applying. This lets you see your chances of approval without hurting your credit score.

LendingClub: Best for Joint Applications and Co-Borrowers

Image Source: Debt.org

LendingClub provides a lifeline through its joint application option for borrowers with credit challenges. This feature lets applicants team up with someone who has stronger credit. Borrowers can tap into loan approval possibilities even when their individual applications might not succeed.

LendingClub co-borrower benefits

LendingClub’s joint personal loans allow both applicants to submit a unified application with equal repayment responsibility. The structure is different from co-signing because both parties get full rights to the loan proceeds. Here’s what you can expect when applying with a co-borrower:

- You might qualify for larger loan amounts than what you’d get individually

- You could get better interest rates by combining financial profiles

- Your approval chances improve if you have credit challenges

Joint applications at LendingClub come with a more favorable debt-to-income (DTI) ratio cap of 35% [link_1], while individual borrowers face a 40% cap. This makes the loans available to applicants with higher debt levels.

LendingClub loan terms and fees

Your monthly payments stay the same throughout the repayment period because LendingClub’s personal loans have fixed interest rates. The lender’s origination fee ranges from 3-6% of your total loan amount based on your credit profile, though some sources say it can go up to 8%.

You won’t find any application fees, broker fees, or upfront charges. The lender lets you make extra payments or pay off loans early without penalties. LendingClub’s payment support team can help if you face financial difficulties – just reach out to learn about your options.

LendingClub credit score requirements

You need a minimum credit score of 600 for LendingClub personal loans [link_2], but the average borrower has a score around 700. The lender requires 36 months of credit history with two active accounts.

LendingClub looks beyond your credit score to review factors like income and debt-to-income ratio. Individual applicants must have a DTI ratio under 40%, while joint applicants can go up to 35%. The lender doesn’t list a minimum income requirement but verifies your income during application. The average borrower makes about $100,000 per year.

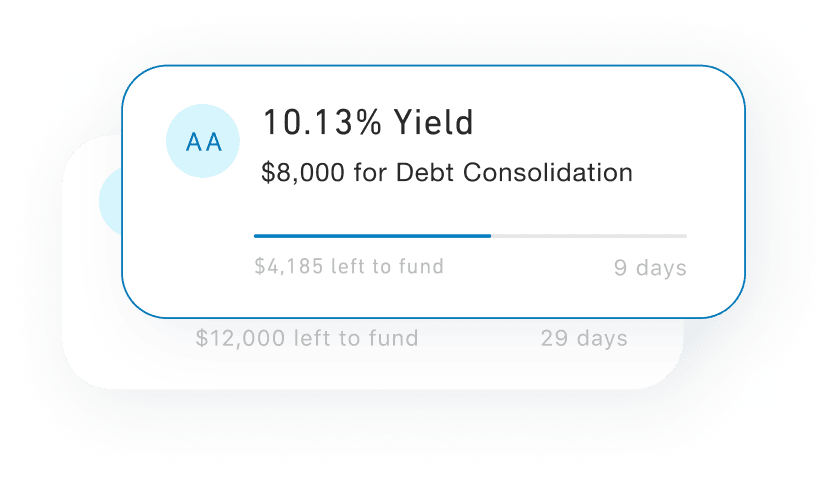

Prosper: Best Peer-to-Peer Lending Option

Image Source: Prosper

Prosper, America’s original peer-to-peer lending platform, creates a marketplace that connects borrowers directly with individual investors who fund personal loans for bad credit. This different approach to traditional lending gives borrowers better chances of approval compared to conventional bank loans.

Prosper peer-to-peer model explained

Prosper works differently from standard lenders by connecting borrowers with real people who invest in their loans. Creditworthy borrowers submit loan requests through Prosper’s marketplace. Investors review these requests and choose to fund portions (notes) of each loan. WebBank originates the approved loan and sells it to Prosper. The investor-funded structure allows peer-to-peer loans to have more flexible qualification requirements than traditional loans.

To qualify, borrowers need

- Minimum credit score of 560

- U.S. citizenship or residency status

- Valid Social Security number

- U.S. bank account

Prosper loan terms and funding time

Prosper’s fixed-rate, unsecured personal loans range from $2,000 to $50,000 with 2 to 5 years‘ repayment terms. Borrowers can expect interest rates between 8.99% to 35.99% APR and origination fees from 1% to 9.99% of the loan amount. Prosper deducts these fees from your loan proceeds before disbursement.

The funding process includes:

- Loan approval takes 1-10 business days in most cases

- Fund delivery takes 1-3 additional business days after approval

Borrowers make fixed monthly payments that include principal, interest, and applicable fees once the loan starts. Prosper reports your payment history to credit bureaus, so timely payments could help improve your credit score.

Prosper hardship relief program

Prosper helps borrowers facing financial difficulties through its hardship assistance options. The Short-Term Hardship program splits your current amount due into six manageable payments over six months. Your interest rate temporarily drops to a 9.99% fixed rate. A $300 monthly payment would become $50 monthly for six months under this program.

Your account status returns to “current” after you make three consecutive on-time payments while continuing the reduced payments. Regular loan terms resume when the six-month period ends. This program gives borrowers breathing room without long-term damage to their credit standing.

Happy Money: Best for Credit Card Debt Consolidation

Image Source: Happy Money

Happy Money stands out from regular lenders by focusing only on credit card debt consolidation. This makes them a perfect fit if you’re dealing with high-interest credit card balances and your credit isn’t perfect. Their Payoff Loan helps borrowers tackle credit card debt through one fixed monthly payment.

Happy Money loan purpose and restrictions

The company keeps things simple with just one product: the Payoff Loan for credit card debt. This laser focus lets them offer better terms for customers in this situation. Your high-interest credit card balances get rolled into one fixed monthly payment at terms that work for you. The company pays your creditors directly, which means the money goes straight to paying down your debt.

You can borrow $5,000 to $40,000 through Happy Money. The loan terms are flexible and run from 2 years (24 months) to 5 years (60 months). Right now, residents of Iowa, Massachusetts, and Nevada can’t get these loans.

Happy Money APR and funding speed

The lending partners set fixed interest rates between 8.95% and 29.99% APR. Loans above $15,000 start at a higher minimum rate of 11.70% APR. Here’s what this looks like: a $25,000 loan at 15.86% interest would cost you $734 monthly for 48 months.

The fee structure is straightforward. You’ll only pay a one-time origination fee of 0% to 5% of your loan amount, which comes out of your initial loan funds. The company doesn’t charge application fees, late fees, early payment penalties, check processing fees, or annual fees.

Most approved borrowers see their money in three to six business days.

Happy Money credit score requirements

You’ll need a minimum FICO credit score of 640 to qualify. The other requirements are simple:

- You must be 18 or older

- You need a valid Social Security number

- You should have an active checking account

- Your credit report must be free of current delinquencies

The results speak for themselves. Borrowers typically see their FICO scores jump by 40 points after making just a few payments. This makes Happy Money a solid choice for rebuilding your credit while getting your debt under control.

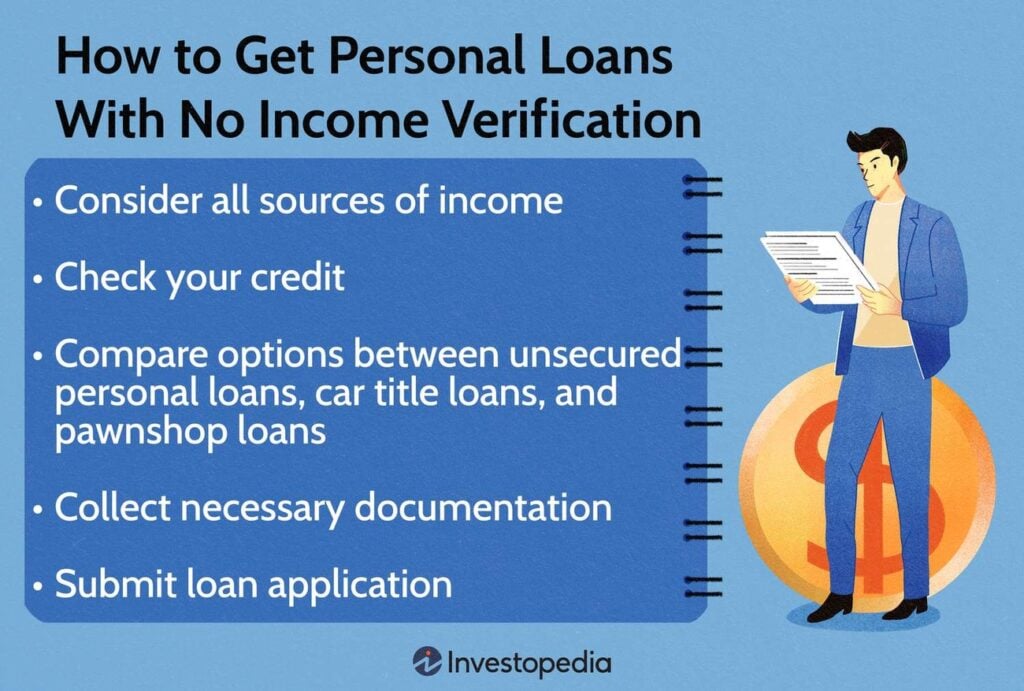

Universal Credit: Best for Credit-Building Tools

Image Source: Investopedia

Universal Credit helps borrowers build credit through personal loans for bad credit. The company stands out by providing credit-building resources and funds to improve borrowers’ financial health.

Universal Credit loan features

Universal Credit offers personal loans from $1,000 to $50,000 with fixed rates that remain stable throughout your repayment period. The company’s optimized online application lets you get pre-approved within minutes without impacting your credit score. You can review multiple loan options and choose an amount and term that matches your budget after approval. Your loan terms can last 36 to 60 months with flexible due dates, so you know exactly when you’ll finish paying.

Universal Credit credit monitoring benefits

Borrowers can access various credit-building tools through Upgrade (Universal Credit’s parent company). These tools include free VantageScore access, a credit score simulator, and live alerts about credit report changes. The company provides personalized credit-building recommendations based on your financial situation. Universal Credit reports to all three major credit bureaus, which helps rebuild your credit profile through timely payments.

Universal Credit APR and fees

Universal Credit personal loans come with Annual Percentage Rates (APRs) between 11.69% and 35.99%. Each loan includes an origination fee between 5.25% to 9.99% that gets deducted from loan proceeds. A $10,000 loan with a 36-month term and 28.47% APR (including a 22.99% interest rate and 7% origination fee) would give you $9,300 with $387.05 monthly payments. Borrowers can get better rates through available discounts—0.50 percentage points off for automatic payments and 1-3 percentage points off for direct creditor payments.

OneMain Financial: Best for In-Person Support and Secured Loans

Image Source: WalletHub

OneMain Financial has helped customers with customized guidance and flexible secured loan options for over 100 years. The company runs more than 1,300 branches across 44 states and provides a high-touch customer experience that’s rare in online lending.

OneMain Financial loan types and flexibility

OneMain provides secured and unsecured personal loans ranging from $1,500 to $20,000 with repayment terms between 24-60 months. Fixed interest rates range from 18.00% to 35.99% APR.

The company stands out because of its secured loan options that help credit-challenged borrowers improve their approval chances. Borrowers can use several types of collateral:

- Automobiles and trucks

- Motorcycles

- Boats and RVs

- Campers

These secured options help borrowers qualify for lower interest rates. Each vehicle used as collateral needs an appraisal to check its value and must have physical damage insurance throughout the loan term.

OneMain Financial credit score acceptance

OneMain Financial has no minimum credit score requirement, making their loans available to borrowers with poor credit histories. The company takes a comprehensive look at applications and assesses factors like

- Income and expenses

- Credit history

- Availability and value of collateral (if applicable)

This approach helps many applicants get funding even after rejections elsewhere. The company accepts joint applications but doesn’t allow co-signers.

OneMain Financial funding and customer service

OneMain makes customer service easily available. You can apply online, by phone, or at any branch location. Approved borrowers can receive funds through:

- SpeedFunds (as fast as 1 hour after closing with a bank-issued debit card)

- Direct deposit (1-2 business days)

- In-person check at branch (same day)

Branch visits connect borrowers with loan specialists who offer customized guidance. The company lets borrowers customize payment dates and change their due date twice during repayment.

Oportun: Best for Small Loan Amounts and No Credit History

Image Source: The Yukon Project

Oportun helps borrowers who need small-dollar loans but have minimal or no credit history. This service fills a vital gap in the personal loans marketplace for people with bad credit. You won’t find many legitimate lenders offering such small loan amounts.

Oportun loan amounts and terms

The company’s loan amounts start at just $300, and unsecured loans go up to $10,000. Borrowers can get secured loans from $2,525 to $18,500 when they use their vehicle as collateral. Loan terms run from 12 to 54 months, so you can pick what works best for your budget. This makes Oportun a great choice when you need smaller amounts that bigger banks usually don’t offer.

The administrative fees can reach up to 10% of your principal amount. Your actual fee might be lower based on your loan size and term length. Let’s look at an example: a $3,333 unsecured loan with a 30-month term and 10% fee means you’d get $3,000 and pay $70 every two weeks for 65 payments.

Oportun credit requirements

What makes Oportun really stand out is their way of evaluating credit. They have no minimum credit score requirement and welcome people who have limited or no credit history. Previous bankruptcy won’t automatically disqualify you either.

You can check your eligibility through prequalification. This only needs a soft credit check that won’t hurt your FICO score. The company takes an integrated approach to reviewing applications and looks beyond traditional credit scores.

Oportun funding speed and availability

Prequalification takes just minutes, while completing the full application needs about 10 minutes with your documents ready. After approval, you can receive funds through direct deposit or paper check. Electronic transfers usually take 1-3 business days.

The service isn’t available everywhere in the US. Thirteen states can’t access Oportun’s services, including Colorado, Connecticut, Massachusetts, Nevada, New York, and Washington. This limits options for some people looking for personal loans with bad credit.

NetCredit: Best for Emergency Loans with Bad Credit

Image Source: NetCredit

NetCredit is a vital lifeline for people who need quick money but have credit problems. The company’s efficient process and flexible requirements make it a great option, especially when you have surprise expenses and regular banks won’t help.

NetCredit loan features and eligibility

NetCredit provides unsecured personal loans up to $10,000 without any minimum FICO credit score requirements. You can qualify if you:

- Are at least 18 years old (19+ in Alabama and Delaware, 21+ in Mississippi)

- Have a personal checking account and email address

- Can show proof of regular income

- Live in one of the 36 states where NetCredit operates

The company first checks if you qualify through a soft credit check that won’t hurt your score. Their “My ScoreSaver” feature lets you see possible offers without any risk. This means you might get approved even with bad credit.

NetCredit APR and repayment terms

Interest rates at NetCredit usually run from 34.00% to 99.99% APR. These rates are much higher than regular personal loans but lower than what most payday lenders charge. You can take up to 60 months to repay, which gives you more flexibility than short-term loans that need full payment in weeks.

The longer payment schedule helps keep monthly payments more affordable, though you’ll pay more interest over time. NetCredit works with partner banks like Capital Community Bank and TAB Bank. They report your payments to major credit bureaus, so paying on time could help rebuild your credit.

NetCredit funding timeline

NetCredit shines when it comes to quick funding. Most approved loans arrive by the next business day. If you apply before 11:00 a.m. CT Monday through Friday, you might even get your money the same day. This makes NetCredit perfect for real emergencies.

Applying is simple. Just share basic details like your name, birthdate, Social Security number, and why you need the loan. NetCredit shows your offers and lets you pick your loan terms. After you choose an offer, they do a hard credit check for final approval.

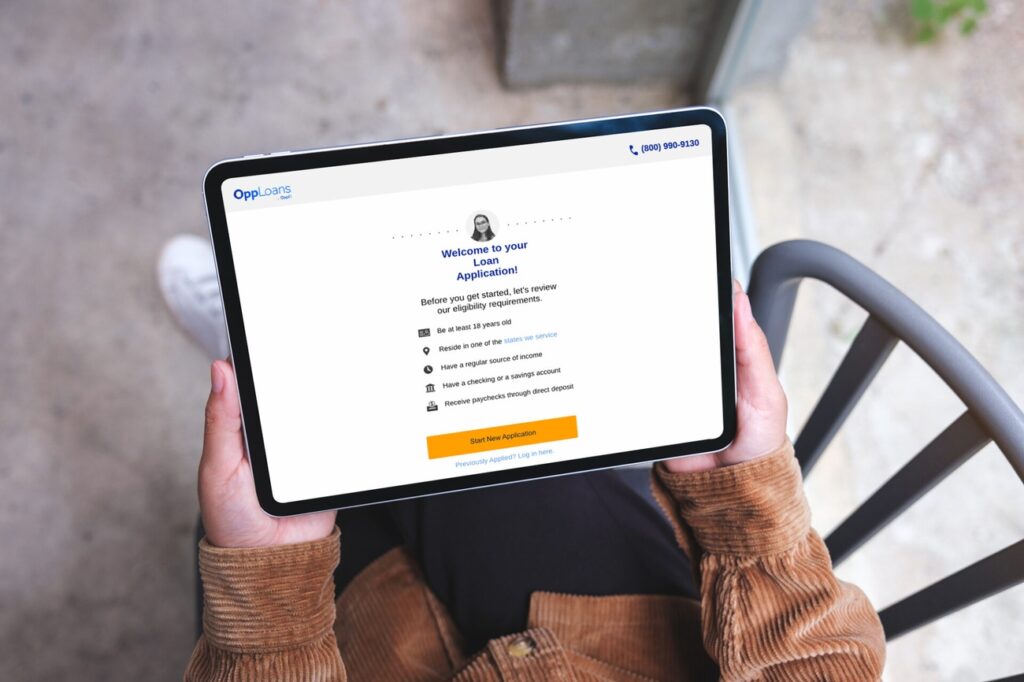

OppLoans: Best for No Credit Check Loans

Image Source: OppLoans

OppLoans markets itself as a payday loan alternative that helps borrowers get funding without a standard credit check. The company operates in the high-cost lending space but offers better-laid-out repayment options than typical payday products.

OppLoans application process

OppLoans runs a soft credit check that won’t affect your FICO score. The company assesses borrowers by looking at their bank account transactions and financial patterns instead of credit scores. You need these things to qualify:

- Monthly gross income of at least $1,500 in most states

- A bank account with direct deposit

- Regular source of income

The application process is simple, and you’ll get most decisions right away. Your funds could arrive the same day if you’re approved before 12 p.m. CT on a business day. Applications after this time usually get funded the next business day.

OppLoans APR and loan limits

OppLoans provides small personal installment loans between $500 and $4,000. The amount you can borrow depends on your state and personal eligibility. You get 9 to 18 months to repay – this is longer than payday loans but shorter than regular personal loans.

The biggest drawback is the interest rates. All loans come with APRs of 160%, and some sources say rates can go up to 195%. Let’s look at an example: if you borrow $2,000 for nine months at 160% APR, you’ll pay about $1,551 just in interest.

One good thing – OppLoans doesn’t charge origination fees, late fees, or prepayment penalties.

OppLoans credit reporting and risks

Unlike many high-cost lenders, OppLoans reports your payment history to TransUnion, Equifax, and Experian. This means you could build your credit score by making payments on time.

OppLoans might help you build credit, but financial experts say loans with APRs above 36% are too expensive. This makes OppLoans a last-resort choice. The very high interest rates could trap you in debt if you can’t keep up with payments.

You can refinance with OppLoans, but this might mean a longer loan term and more interest costs overall.

SeedFi: Best for Building Credit While Borrowing

Image Source: TriceLoans

SeedFi brings a fresh take on credit-builder loans by letting you build credit and save money without paying any interest. Traditional personal loans for bad credit come with hefty interest rates, but SeedFi’s Credit Builder Prime stands alone with its 0% APR and zero interest charges.

SeedFi credit-builder loan structure

The program works through a simple dual-account system. SeedFi creates a line of credit and a savings account in your name after enrollment. The process follows a straightforward cycle: SeedFi puts money into your savings account from your line of credit before each paycheck, which creates a short-term debt without interest. You repay the line of credit once your paycheck arrives, and that savings amount becomes yours. This cycle continues to boost both your credit score and savings.

Your credit profile gets stronger each month as SeedFi sends your line of credit account status and payment details to all three major credit bureaus.

SeedFi loan terms and savings component

The program starts with just $10 per month, making it one of today’s most budget-friendly credit-building options. The program lets you access your money after you save $500. You can withdraw your funds or keep building more savings.

SeedFi gives you payment flexibility. While regular payments help you save faster, you only need to make one payment in the first three months and another every six months after that. Your contributions go straight to savings without any interest deductions.

SeedFi eligibility and benefits

Users see their credit scores jump by 41 points on average after six months of regular use. This program helps people who want to build credit while creating an emergency fund – tackling two financial goals at once.

SeedFi’s key advantages include

- Zero interest costs—unlike other credit builder loans that charge interest

- Low monthly payments starting at just $10

- Reporting to all three credit bureaus

- Automated savings through their Autosave program

- No risk of negative reporting if you follow the minimum activity requirements

Intuit, Credit Karma’s parent company, has acquired SeedFi. This acquisition might expand services for people looking for bad credit loans with credit-building features.

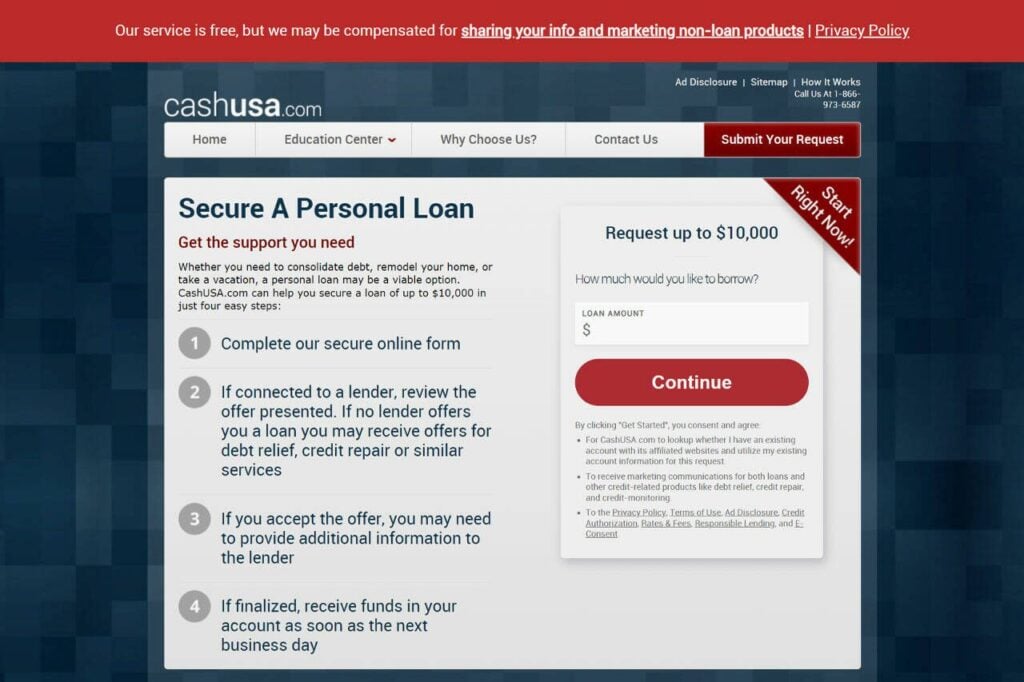

CashUSA: Best Loan Marketplace for Bad Credit

Image Source: Everett Herald

CashUSA acts as a bridge between credit-challenged borrowers and potential lenders through its marketplace network. This 15-year-old platform doesn’t give out loans directly but matches people seeking bad credit personal loans with lenders.

CashUSA lender network and loan matching

CashUSA works with many lenders who are ready to look at applications from borrowers with credit issues. The platform shows your information to their network of lenders and third-party lending networks, who then choose whether to give you a loan. The platform uses a “ping-tree” model that links customers with the highest-bidding lender rather than the one with the best terms. When no lender makes an offer, CashUSA might share basic information with marketing partners who provide credit repair or debt relief services.

CashUSA application process

You can complete the short online form in just minutes. Qualified applicants must:

- Be at least 18 years old and a US citizen or permanent resident

- Have been hired for at least 90 days

- Earn a minimum of $1,000 monthly after taxes

- Have a valid checking account in their name

- Provide work and home phone numbers plus a valid email address

We accepted all credit types without asking for a minimum credit score. Once approved, you’ll go to the lender’s site to review their specific terms before accepting.

CashUSA loan amounts and terms

The platform links borrowers to lenders who offer personal loans from $500 to $10,000, though amounts differ by state and individual eligibility. You can repay these loans over 90 days to 72 months. Your financial profile determines the interest rates, with APRs ranging between 5.99% and 35.99%.

CashUSA doesn’t charge any fees for matching services. Lenders set all fees and interest rates and must show these details upfront as required by the Truth in Lending Act. People who accept loan offers might see funds in their bank accounts by the next business day.

MoneyMutual: Best for Quick Loan Matching with Bad Credit

Image Source: BadCredit.org

MoneyMutual connects borrowers who have poor credit to potential lenders faster through its simplified lending platform. The service helps people with credit challenges find funding options through a quick five-minute application when regular banks say no.

MoneyMutual loan types and partners

MoneyMutual works together with more than 60 short-term lenders who help people with damaged, low, or poor credit scores. Their partners offer various loan types like installment loans and payday loans. You can borrow anywhere from $200 to $5,000 based on qualifying factors and state regulations.

Note that MoneyMutual doesn’t lend money directly but connects borrowers to lenders who work with credit-challenged applicants. Once you submit your information, lenders look it over and decide if they want to work with you. They’ll then take you to their website to complete everything. Each lender has their own terms and conditions, which you can review before saying yes.

MoneyMutual approval speed

The application takes just five minutes to finish—even less time for returning customers. Lenders usually make their decisions within minutes after you submit. If approved, money can show up in your account in as little as 24 hours.

The process is straightforward: submit your information through MoneyMutual’s secure platform, get live loan offers from interested lenders, and then look at rates and terms before you decide. Once you accept an offer, the lender takes care of everything else about the loan.

MoneyMutual credit score flexibility

MoneyMutual’s biggest advantage is how it works with all credit types. Some partner lenders look at things like income and employment history instead of running traditional credit checks that might hurt your score more.

To get considered, you’ll need to:

- Be at least 18 years old and a U.S. resident

- Currently employed or receiving regular income

- Earn at least $800 per month

- Have an active checking account

MoneyMutual’s service comes free with no pressure to accept any loan offers. This makes it a safe way to learn about lending options even with credit limitations.